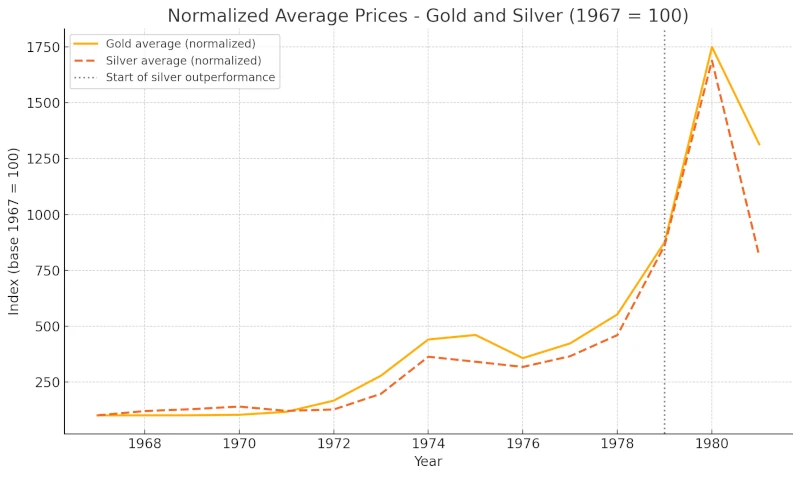

Between 1967 and 1981, gold and silver experienced one of the most turbulent and fascinating periods in the history of precious metals. Although both experienced significant increases, their trajectories diverged dramatically toward the end of the period. A careful analysis of this evolution allows us to better understand both the market dynamics and the narratives that still influence investors today.

👉 Read also: Maybe I Understand Why Silver Is Worth So Little

I am not a financial advisor:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

Contents

#1. Gold and silver grow together

In the late 1960s, both gold and silver were trading at relatively stable and low prices. Gold was pegged at around $35 per ounce under the Bretton Woods system, while silver was around $1.30. With the end of gold convertibility in 1971 and the profound economic changes of the 1970s (high inflation, energy crisis, distrust of currencies) precious metals began a significant climb.

From 1967 to 1978, gold rose from about $35 to nearly $200 an ounce, a more than five-fold increase. Silver, though less spectacular in absolute terms, rose from about $1.29 to just under $6. The two metals moved in similar ways, reflecting the growing demand for safe havens in an unstable economic environment.

👉 Read also: Today, Compared to the Last Gold Rush of the 70s…

Gold gradually assumed the role of store of value par excellence, but silver also followed suit, confirming itself as a credible alternative. By the late 1970s, both had won the trust of investors and seemed destined to maintain a long-term trend. Up to that point, silver had not shown a markedly superior performance to gold: rather, the two metals had followed a parallel path, with the latter slightly more stable.

This steady growth was only interrupted after 1978, when external and speculative factors began to drastically influence the silver market.

#2. Silver takes flight

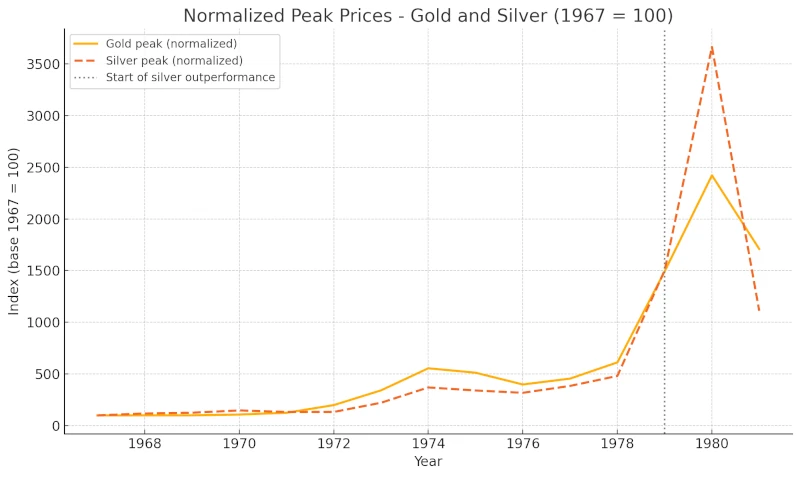

In the space of little more than a year, silver took center stage with a performance that even eclipsed that of gold. Between 1979 and early 1980, the price of silver exploded from around $6 to nearly $50 an ounce. Gold also saw strong increases, from under $300 to over $800, but silver’s relative increase was far more extreme.

This sudden divergence led many observers to speak of silver as the new gold standard. In percentage terms, the increase seemed to confirm its superiority, but the causes of this rally were far from natural. Unlike gold, which was supported by macroeconomic dynamics, silver’s surge was largely induced.

The event restructured the perception of silver as an investment: no longer just a companion to gold, but a potential star of the metals market. This idea survives today, often without considering how exceptional the conditions were that led to the 1980 boom.

To truly understand this moment, one must analyze the central role of the Hunt brothers, the main architects of this race.

#3. The Hunt brothers’ speculation

Nelson Bunker Hunt and William Herbert Hunt, heirs to a very wealthy Texas oil family, feared the devaluation of the dollar and inflation. Driven by this belief, and by a certain speculative ambition, they began to accumulate huge quantities of silver in the 1970s. At first they concentrated on physical purchases, but later they threw themselves forcefully into the futures market.

By the end of 1979, the Hunt brothers controlled over 100 million ounces of silver, both physical and futures. Their operations drastically reduced the available supply and sent the price skyrocketing. At one point, they were estimated to hold more than half of the world’s actual available silver.

The market responded, but so did the authorities. The COMEX changed its rules to limit speculative positions, and the Federal Reserve increased margin requirements. These moves caused the price of silver to suddenly collapse in March 1980, in what is known as “Silver Thursday.”

The price fell from nearly $50 to less than $11 in a matter of weeks. The Hunt brothers were investigated and faced serious financial difficulties. Their attempt to manipulate the market remains one of the most emblematic cases of extreme speculation in the history of finance.

#4. Disillusionment with silver

The idea that silver is destined to overtake gold originates from that extraordinary episode between 1979 and 1980. However, it is important to remember that this was an absolutely exceptional and, to a large extent, artificial context. In the absence of the Hunt brothers’ speculation, it is likely that silver would have continued to follow gold in a parallel fashion, without sudden bursts.

Silver remains a precious metal with an industrial role, but its volatility and sensitivity to exogenous dynamics make it less reliable than gold as a store of value. Some modern narratives, which present silver as a goldmine of opportunities, risk transmitting excessive expectations. In some cases, this narrative is used to incentivize purchases by poorly informed savers, fueling a vision that is not entirely realistic.

If a new bull market for precious metals were to open in the future, gold is more likely to lead the market, due to its historical function, lower volatility, and adoption by central banks and large investors. Silver could certainly benefit, but it is unlikely to show the same extraordinary performance without similar manipulative events as in the past.

In summary, silver is an interesting asset, but the idea that it will naturally outperform gold in the long run is not supported by historical data and current market structures.

In any case, keep in mind that if most investors (who are almost always retail) do not follow this same reasoning, the logic just presented might not apply immediately. As a result, silver could, even without concrete reasons, outperform gold from a certain point onward.

Leave a Reply