In recent years, we have heard more and more about the digital euro. Some describe it as a revolution that will lead us straight to a cashless society, others see it as a monetary big brother, capable of controlling our every purchase. But behind these polarized narratives lies a much more concrete reality, less fascinating perhaps, but definitely more understandable.

The digital euro is not a cryptocurrency, it is not a trick to spy on citizens, nor an experiment in total control. It is, more simply, the technological adaptation of the euro to the era of electronic payments.

Contents

#1. What is digital euro, when will arrive?

The digital euro is an electronic form of official money issued by the European Central Bank. Unlike the euro that we use every day through bank accounts, which are actually just “promises” of payment by commercial banks, the digital euro will be directly guaranteed by the ECB. This means that we will have, for the first time, a digital instrument with the same legal value as banknotes, but in a purely electronic form.

It is not a cryptocurrency like Bitcoin or Ethereum: it will not be decentralized, it will not use a public blockchain, and it will not be subject to wild market fluctuations. The digital euro will be stable, centralized, and integrated into the existing financial system. It can be stored on an official app or in authorized wallets, perhaps even on physical devices, but it will not be tied to a traditional bank account.

The ECB began studying the digital euro already in 2020. After various phases of analysis, public consultations and technical tests, the planning phase began in 2023. The project is now in the infrastructure implementation phase. The official launch date has not yet been decided, but it is expected that it could be introduced between 2026 and 2028, depending on the political choices of the member countries and the technological maturity of the system.

It should be emphasized that its arrival will not be sudden, nor mandatory. It is likely that in a first phase the digital euro will be used in parallel with current methods, and only gradually will it gain a significant role in everyday payments. It will be designed for small retail payments, as an alternative to cash and cards, but with greater control and stability.

The digital euro is also an attempt to counter the growing influence of tech giants in the digital payments sector, such as Apple, Google or Alipay. Ensuring a public and sovereign infrastructure is also a way to prevent the future digital economy from being exclusively dependent on entities outside the European Union.

In short, the digital euro is a technological upgrade of our currency. A way to ensure that the euro continues to exist and function even in a future where cash will be used less and less and where private individuals (such as Big Tech or stablecoin issuers) do not become the masters of the payment system.

#2. Why is it needed, pros and cons

To understand why there is so much talk about the digital euro, you need to look at what is changing in the world of payments. Today, most transactions are done electronically: with cards, bank transfers, apps. But these forms of payment are not directly guaranteed by the State, but by private entities such as banks or international circuits. If your bank goes bankrupt tomorrow, your account balance is not 100% protected. If a circuit is blocked, your money can remain unusable for hours or days. The digital euro, on the other hand, being the currency of the ECB, has the same level of security as a banknote.

👉 Read also: Why the 100k Euros Are Safe on a Current Account

One of the central reasons for the introduction is therefore monetary sovereignty. The ECB wants to prevent European citizens from ending up using digital currencies issued by private companies or external states (such as China or the USA). Offering a public, safe and accessible alternative is a way to remain masters of our economic system.

From a technical and social point of view, the digital euro could improve financial inclusion, especially for those who do not currently have access to a bank account. If designed well, it could also allow offline payments, as a sort of “digital banknote” on a smart card or smartphone. Furthermore, it could facilitate the spread of instant and more efficient payments, with lower costs than those applied by many banks.

But not everything is positive. One of the main concerns is privacy: who will guarantee that payments are not traceable? The ECB has assured that the digital euro will be designed with privacy in mind, but some form of traceability will be inevitable. And this is frightening, especially for those who see digital currency as a potential tool for social control.

Another perceived disadvantage is the effect on the banking system. If citizens could hold digital euros directly at the ECB, some commercial banks might find themselves with fewer deposits, reducing their lending capacity. To avoid this scenario, it is likely that a limit will be imposed on the amount of digital euros that a single citizen can hold.

User experience is also a critical issue. If the official ECB app is too complex or not very intuitive, it risks being used only by a minority, while private services will remain dominant. In short, the digital euro will not be a magic wand: it will be useful only if it is designed to truly simplify daily life.

#3. Conspiracies and unfounded fears

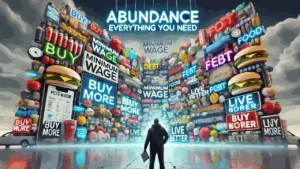

One of the most recurring alarms launched by conspiracy groups or alarmist voices concerns the idea that the digital euro will be “mandatory”, that it will lead to the abolition of cash, and that it will allow governments to turn off your money with a click. But it is important to state clearly that these fears do not correspond to the reality of the facts.

First of all, the euro has been digital for decades. The money in your account is not banknotes, but numbers in a database. Those numbers are blockable, traceable, transferable and everything that can be attributed to the digital euro is already technically possible today. If your bank decides to suspend your account today (by court order or for internal reasons), you cannot withdraw a cent. The digital euro does not increase this possibility, if anything it makes it more transparent and managed by a public body rather than by private entities.

Second, the ECB has stated several times in official documents that cash will continue to exist. The digital euro will be an additional option, not a replacement. It will be designed for those who want to pay electronically without depending on commercial banks or technology giants. Those who love cash will be able to continue using it. And those who do not trust the digital system will always be able to opt for material alternatives such as physical gold, which for centuries has represented a store of value outside the banking circuit.

Finally, the real issue is not that money becomes blockable: it already is. The real issue is who controls it. With the digital euro, this control would shift from private entities to the ECB. This could even reduce abuse, if accompanied by clear rules and transparent governance. It is therefore essential to separate real fears from unfounded ones, and to evaluate technology for what it is, not for what we fear it might become..

Leave a Reply