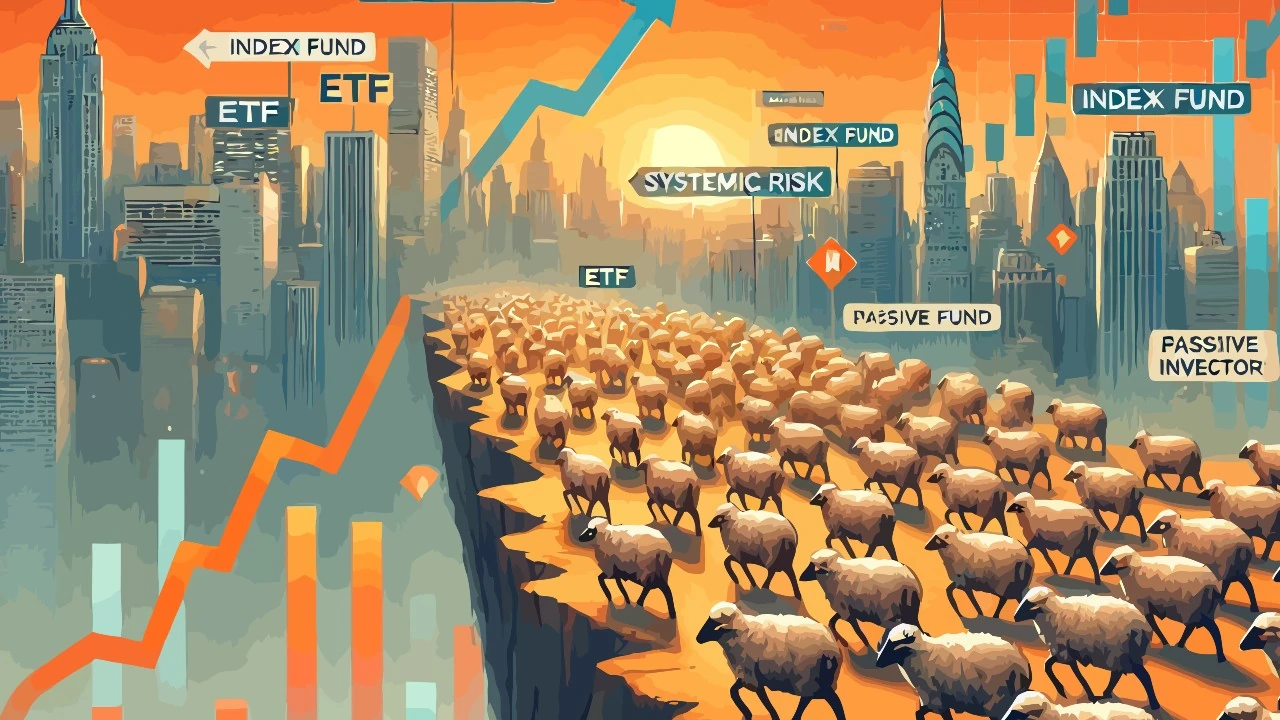

The world of investments has undergone a radical transformation in the last twenty years. Index funds, ETFs (exchange-traded funds) and SIPs (systematic investment plans) have revolutionized access to financial markets, reducing costs and simplifying choices. Millions of savers today invest passively, without analyzing company fundamentals.

But if everyone buys the same tools, following automated logic, what happens in the event of a crisis? This article analyzes the phenomenon with data, critical opinions and dangerous scenarios that could materialize between 2027 and 2030.

I am not a financial advisor:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

Contents

#1. The rise of passive investing

Passive investing has gained ground as a reaction to the inefficiency and high costs of active management. After the 2008 financial crisis, many investors lost faith in professional managers, moving towards less expensive and more predictable solutions. Index funds, which replicate the behavior of indices such as the S&P 500, the MSCI World or the EuroStoxx 50, have become the preferred choice for those seeking long-term growth without having to make complex decisions.

According to Morningstar, in 2024 passive funds will have exceeded 13,000 billion dollars of assets managed globally. In the United States, passive funds represent over 55% of the total, while in Europe the share exceeds 35%. In Italy, Assogestioni data show that in 2023 SIPs in ETFs have raised almost 7 billion euros, a strong growth compared to the 2 billion in 2018.

Success is also cultural: platforms such as eToro and Moneyfarm actively promote automatic investments through simple interfaces and guided paths. Communication is centered on “convenience” and “peace of mind”, fueling the idea that the long term solves every problem. But this very automatism is at the center of new critical issues.

According to Vincent Deluard, macro analyst at StoneX:

Passive investing has become a secular religion, with millions of investors buying instruments without asking questions.

The risk is that blind faith in simplicity leads to collective self-deception.

#2. The automatism of ETFs and SIPs

ETFs are instruments designed to replicate market indices. They are tradable on the stock exchange like stocks, but they do not actively select the securities: they purchase the components of the index based on their capitalization. SIPs, on the other hand, are investment plans with a regular cadence, often monthly, that allow even small savers to invest gradually. SIPs and ETFs often merge into a single passive strategy: ETF shares are purchased every month, automatically.

The advantages are obvious: reduced costs, ease of operation, apparent diversification. However, what appears to be diversified is not. An ETF on the S&P 500, for example, in 2023 saw over 27% of its weight concentrated in seven technology companies. This means that SIPs in equity ETFs expose the investor to an often underestimated sector risk.

Passive replication also introduces vulnerabilities. If a stock enters an index, it will immediately receive automatic inflows; if it leaves, it will be sold en masse. This creates a system in which the price of stocks is increasingly determined by capital flows, and less and less by their profitability, leverage, or innovation.

Mohamed El-Erian, former CEO of Pimco, said:

ETFs have improved access to markets, but have also shifted the focus from quality to quantity.

Finally, few investors wonder what would happen if the automatic mechanism were to be suspended. Passive management presupposes the constant liquidity of the underlying assets, but in times of market stress this condition may be lost.

#3. Distortions in the markets

The main distortion generated by passive accumulation is concentration. Capital flows in proportion to capitalization, rewarding the largest stocks regardless of their real value. This pro-cyclical mechanism fuels a self-referential growth cycle: the more a stock grows, the more capital it receives, the more it increases in price.

According to an analysis by Bank of America, in 2024, more than 60% of the S&P 500’s return was generated by less than 10% of the stocks. This imbalance undermines the traditional function of markets, which is to discover prices by comparing sellers and buyers with differing opinions. If everyone buys by definition what is “in an index,” the market stops evaluating and starts following.

Silent bubbles created by liabilities are not as flashy as those of the past. There are no extravagant valuations or unknown companies exploding for no reason. The danger is more subtle: an apparent stability supported by automatic inflows and not fundamental valuations.

According to Michael Burry, known for predicting the subprime mortgage crisis in 2008:

Passive investing is a bigger bubble than 2007, because no one knows where the real risk lies.

To make a comparison that conveys the idea very well, even if not exactly coherent, it is enough to think about the mechanism of how the Powerball works: the prize pool always increases because people continuously play the cards, almost automatically.

#4. Risks and crisis scenarios 2027–2030

If passive accumulation continues to grow at the current pace, by 2030 the majority of capital in developed markets will be managed in an automated manner. This scenario carries obvious risks: homogeneity of behavior, apparent liquidity, excessive indirect leverage. A small exogenous event could trigger a disproportionate reaction.

One possible scenario is a sudden increase in interest rates. If bonds return to yielding 5–6%, many investors may abandon equity ETFs and return to safer instruments. A drop in inflows would cause selling, with violent drops in prices. Another scenario is a geopolitical or environmental crisis that suddenly makes certain sectors (technology, energy, banking) less attractive, generating automatic concentrated selling.

The crisis could also be triggered by a political or fiscal event. The introduction of taxes on capital, transactions or automatic savings instruments, for example in Europe, could destabilize SIPs. Or a review of the role of index providers could reveal flaws in the construction of ETFs themselves.

According to Larry Fink, CEO of BlackRock (one of the largest ETF managers in the world):

The real vulnerability of the system is the belief that everything is under control, while no one drives the car anymore.

Systemic risk is no longer generated by irrational greed, but by mechanical rationality taken to excess.

#5. Opinions and possible solutions

The debate in the financial world is heated. Some, like Jack Bogle (founder of Vanguard, recently deceased), have warned that:

When index funds have 75% of the market, no one will be responsible for capitalism anymore.

Others, like Ray Dalio, founder of Bridgewater, argue that passive investing is sustainable only if accompanied by true diversification and awareness.

Among the proposed solutions we find:

- Limitation of the maximum weight that a single security can have in a replicated index,

- Adoption of ETFs based on fundamental criteria (earnings per share, balance sheet, dividends),

- Greater transparency on index construction rules,

- Creating automatic systems that slow down sales in stressful situations (circuit breaker),

- Financial education as a prevention tool.

European regulation is also moving: in 2024, ESMA (European Markets Authority) has launched an investigation into the functioning of sector and bond ETFs. The debate is still open, but the urgency is clear.

The market cannot be left entirely to automatic logic. The crisis that could emerge between 2027 and 2030 would not be the result of greed or fraud, but of a collective blindness hidden behind efficiency. To avoid it, we must return to look inside the structures.

Leave a Reply