We live in an era where the dream of instant success is sold as a commercial product. It is almost impossible lately not to come across at least once a day invasive and at times toxic advertising designed to encourage you to entrust your money to a supposed expert, who almost always turns out to be a fake guru or rather a fake guru.

In this article, we analyze the phenomenon, highlighting its dangers and suggesting solutions to protect yourself from digital traps.

Contents

#1. Invasiveness on social networks

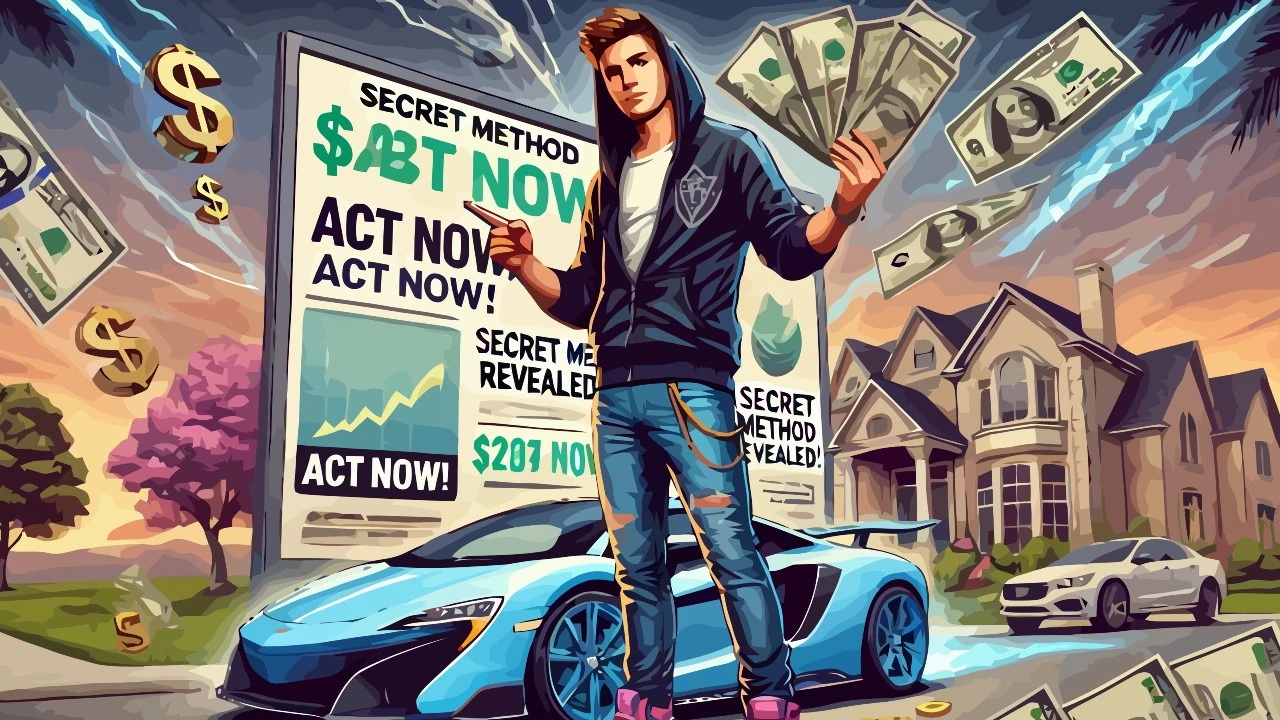

Scrolling through any social page, it is almost impossible not to come across advertisements that promise easy earnings, miraculous courses and secret strategies to make money. These ads appear everywhere: on YouTube before a video, on Instagram between stories, on Facebook between one post and another. The problem is not only their frequency, but the way in which they are presented.

Many of these contents use clickbait strategies (forgive me for the Englishness, but I don’t know how to translate it with the same effectiveness), such as catchy titles and images of ostentatious luxury (cars, villas, designer watches), to attract attention. They are based on a repetitive formula:

If you are not rich it is because you do not know this secret.

These messages exploit a very specific psychological mechanism : they leverage the desire to improve one’s economic situation and the fear of falling behind others.

Furthermore, many social platforms allow and favor this content, since it generates interactions and therefore profit for the same companies. Even when users report these ads as misleading, they often continue to appear with small variations.

The most invasive ads are those that interrupt other types of content, forcing the viewer to see the message even for just a few seconds. Some platforms are introducing tools to limit misleading advertising, but the problem remains widespread. Many users feel inundated by these ads, contributing to the growing distrust towards the world of digital sales.

Another worrying aspect is that these ads often adapt to user searches and conversations. Just search for information on “how to make money online” and you are bombarded with dozens of similar offers. This creates an echo effect that makes it difficult to distinguish real opportunities from scams.

#2. Aggressive and manipulative selling

The most disturbing aspect of this phenomenon is the aggressive tone with which these gurus advertise themselves. They don’t just propose an opportunity: they impose it. They often make the viewer feel inferior or “stupid” if they don’t jump at their “offer of a lifetime.”

A common example is the classic video where a guru says:

If you are watching this video and don’t take action now, you are choosing to stay poor.

This manipulative rhetoric is based on concepts of artificial urgency, forcing people to make hasty decisions, without clearly analyzing what is being offered to them.

The most used techniques include:

- Fictitious Scarcity: “Only the top 10 will be able to access this system.”

- FOMO (acronym for Fear Of Missing Out): “If you don’t act now, you could miss the once in a lifetime opportunity!”

- Personal Attacks: “If you are not successful, it is your own fault!”

Many of these ads are accompanied by fake reviews, artfully created to convince the viewer of the quality of the product. In addition, the gurus exploit emotional videos in which they show their dream lifestyle, making it appear as if it is easily achievable.

This strategy aims to generate a sense of urgency and inadequacy, leading many people to invest sums of money without having a clear picture of what they are actually buying.

In addition to psychological manipulation, these techniques pose an ethical and legal problem. Many of these gurus operate in gray areas of the law, avoiding precise regulations and creating a spiral of investments that users struggle to escape. Without adequate protections, consumers are left at the mercy of deceptive promises.

These increasingly sophisticated methods are able to target both those who are looking for new opportunities and those who are going through economic hardship. The only way to counteract this phenomenon is to spread awareness and provide tools to recognize manipulative techniques.è diffondere consapevolezza e fornire strumenti per riconoscere le tecniche manipolative.

#3. Lack of transparency

Many of these “gurus” carefully avoid explaining how they actually make money. They talk about “secret methods,” “unknown strategies,” and “revolutionary systems,” but when you dig deeper you discover that their only real income comes from selling the courses themselves.

These characters exploit the gullibility of those who want a quick fix to their financial problems, without ever providing details on how their methods might work in practice. Many of them show screenshots of exorbitant earnings or videos in which they flaunt their wealth, but rarely share concrete evidence that can be verified.

Scams hide behind vague and ambiguous language, with expressions such as:

- “I discovered a system that the banks don’t want you to know about!”,

- “This method has made hundreds of my students millionaires!”,

- “No experience needed, anyone can do it!”.

However, when you dig deeper, you find that there is no magic formula. The real income of these gurus comes exclusively from the courses they sell, and not from the strategies they teach.

Another critical aspect is the lack of concrete references. These people often avoid providing legal details about their businesses or only show fake testimonials, with fictitious or manipulated reviews. Those who sign up for their courses often find themselves trapped in a cycle where they are continually pushed to spend more money to get “exclusive” information, which in reality does not lead to any real results.

Furthermore, many of these courses involve a disguised pyramid scheme, in which users are incentivized to recruit new people to earn money, turning the system into a chain with no real productive value. This structure, already illegal in many countries, continues to thrive online thanks to legal loopholes and the difficulty of regulating the web.

Cryptocurrencies , in particular, are among the most used tools by financial gurus to amplify the promised profits. Due to their poor regulation, they can be easily manipulated with speculative strategies, generating artificial price spikes that attract new investors. Often, these operations are based on pump and dump schemes, where the value of a cryptocurrency is artificially inflated and then suddenly collapses, leaving small investors with huge losses.

#4. Exploitation of problems

One of the most questionable aspects of these gurus is the way they leverage social issues to manipulate the public. They exploit job insecurity, unemployment, the economic crisis and people’s frustration to make them believe that their “solution” is the only way out.

For example, during the COVID-19 “pandemic,” many of these “experts” promoted cryptocurrency trading or investing courses as “the only way to survive the crisis”.

The most common messages include:

- “Traditional work is a trap, you have to create your own financial freedom”,

- “School doesn’t teach you how to get rich, I do”,

- “You are poor because you follow the rules of society”.

These concepts exploit fear and dissatisfaction to convince people to make impulsive choices. In reality, those who follow these promises often find themselves without money and without real skills.

The use of fear is a key element of these strategies. The gurus paint catastrophic scenarios for those who follow the “old system”, promising instead a quick way to success to those who adhere to their proposals. The problem is that many of these solutions not only do not work, but can worsen the financial situation of those who are already in difficulty.

Furthermore, these gurus present themselves as “savior” figures who understand the frustration of the public. They create a community around their brand, making followers feel part of a movement that opposes traditional systems. This psychological dynamic makes it even more difficult for victims to admit that they have been deceived, because it would mean acknowledging that they have placed their trust in a fraudulent figure.

This manipulation leads many individuals to go into debt to take these courses, hoping to improve their financial lives, only to discover too late that they have fallen for a well-crafted illusion.

#5. The allure of financial freedom

One of the key elements of the promises of easy money gurus is financial freedom. This is a concept that, in theory, means being able to live without depending on a traditional job, earning money through investments, digital businesses or other passive activities. However, in the context of online gurus, this idea is often distorted and simplified.

Gurus paint an idyllic picture of people working a few hours a day from exotic locations, stress-free and making huge profits. However, they overlook the fact that building true financial independence requires skill, time and careful risk management.

Many courses sold promise immediate results, making people believe that it is possible to earn thousands of euros per month with just a few clicks. This message is particularly dangerous because it leads people to believe in a simple and fast solution, without considering the practical aspects and real risks.

Those who purchase these courses often find that the information provided is superficial and not enough to generate real income. Many methods taught are simple revisitations of existing strategies, difficult to apply without real experience. Furthermore, some courses require additional investments, creating a spiral of continuous expenses without a real economic return.

The false dream of financial freedom is fueled by people’s economic frustration. Those in difficulty are looking for a quick way out, and these gurus exploit this need by selling the illusion that money is easily accessible to everyone. In reality, the only real profit is what the gurus get by selling their promises.

#6. False testimony and persuasion

One of the most effective tools used by easy money gurus is fake testimonials. These individuals post reviews of supposed students who have achieved “amazing results,” showing screenshots of impressive earnings and success stories that seem too good to be true. And in most cases, they are not.

Persuasion strategies used include:

- Fake Reviews: Testimonials created ad hoc or by paid contributors,

- Falsified Screenshots: Changes to financial data to show non-existent earnings,

- Emotional Videos: Engaging stories that focus on fear and hope.

These contents leverage a well-known psychological principle: the social proof bias. People tend to trust what seems to have already been successfully tested by others. If they see hundreds of positive comments and apparent proof of earnings, it is easier for them to make impulsive decisions and purchase the proposed courses.

In addition to fake testimonials, gurus use other techniques to push users to buy immediately, such as:

- Artificial scarcity: “only 10 places available!”,

- Fictitious urgency: “offer valid today only!”,

- Fear of being left behind: “If you don’t act now, you will remain poor forever!”.

All these elements contribute to creating a sense of pressure that leads people to invest money without rational analysis, relying on emotions rather than logic.

#7. How to protect yourself from scams

To protect yourself from easy money gurus, it is essential to develop critical thinking and learn to recognize the signs of scams. Some useful tips include:

- Verify information: Research who is selling the course, look for independent reviews, and check the credentials of the “guru”,

- Don’t be fooled by testimonials: Be wary of overly positive reviews and earnings screenshots,

- Avoid impulsive decisions: If an offer seems too good to be true, it probably is,

- Study legitimate methods of earning: Learn about concepts such as investing, entrepreneurship and sales from reputable sources.

Anyone looking for income opportunities should be aware that there are no shortcuts. Building a sustainable income requires commitment, serious training and careful management of financial resources.

#8. Solutions to counter the phenomenon

To combat the spread of these scams, a multi-pronged approach is needed. Some possible solutions include:

- More regulation of online advertising: Social media platforms should apply stricter criteria to prevent the promotion of fraudulent schemes,

- Financial education: Introduction of programs that teach citizens to recognize scams and manage money consciously,

- Increase reporting: Users should actively report misleading content to reduce its spread,

- Tougher Penalties: Authorities should punish those who spread scam courses with fines and legal restrictions.

Only through greater control and widespread education will it be possible to reduce the influence of these false gurus and protect the most vulnerable people from their manipulations.

Leave a Reply