Rising prices are one of the most tangible aspects of inflation and have profound repercussions on the economy and daily life. Two key factors directly influence this phenomenon: the inflation of the money supply and the velocity of circulation of money .

Understanding the connection between these elements is fundamental to interpreting economic dynamics and the monetary policies adopted by governments and central banks.

Contents

#1. Definition of money supply

The money supply represents the total amount of money available in an economy at a given time. It is divided into different categories to reflect the various levels of liquidity and accessibility of money to different economic actors. Understanding the composition of the money supply is essential to analyzing the effect that its expansion or contraction can have on the economy.

- M0: includes all cash in circulation and deposited at the central bank. It is the most liquid and immediately available monetary base,

- M1: includes M0 plus demand deposits at commercial banks. This measure reflects money that can be used directly to make payments,

- M2: Includes M1 plus savings and short-term deposits . These funds are less liquid than M1, but can be quickly converted into cash,

- M3: adds short-term debt securities and other liquid financial instruments to M2 . It provides a broader view of the availability of money in the economy.

Money supply expansion can stimulate economic growth if well managed, but excessive increases can lead to inflationary pressures.

L’espansione della massa monetaria può stimolare la crescita economica se ben gestita, ma un aumento eccessivo può portare a pressioni inflazionistiche.

#2. The velocity of circulation

The velocity of money indicates how many times a unit of money is used to purchase goods and services in a given period. It is a fundamental indicator for understanding the vitality of the economy and the effectiveness of monetary policy.

The formula to calculate the speed of circulation is:

V = P x Q / M

Where:

- V = velocity of circulation of money

- P = general price level

- Q = quantity of goods and services produced

- M = money supply

A high velocity suggests a growing economy with a high level of business transactions, while a low velocity may indicate stagnation or low consumer confidence. Factors such as consumer confidence, interest rates, and economic stability directly influence the velocity of money.

#3. Relationship: mass and velocity

The quantity theory of money states that an increase in the money supply or its velocity leads to an increase in prices, according to the equation:

M x V = P x Q

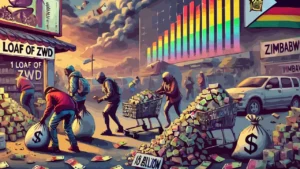

If the supply of goods and services (Q) remains stable, an increase in M or V is directly reflected in P (prices). This means that an excessive creation of money or a sudden increase in its velocity of circulation can increase prices. Practical examples of this phenomenon are observed during economic crises or in periods of strong economic expansion.

Expansionary monetary policies, such as quantitative easing (the famous QE), increase the available money supply, but the effect on prices also depends on the speed with which this new money is spent. If consumers and businesses hold on to money without spending it, the increase in prices can be limited.

#4. Inflationary dynamics

Inflation can be fueled by several factors:

- Demand-pull inflation: Occurs when the demand for goods and services exceeds the available supply, leading to an increase in prices,

- Cost-push inflation: occurs when production costs increase and firms pass these increases on to final consumers,

- Structural inflation: linked to long-term economic imbalances that influence price growth.

Central banks play a crucial role in controlling inflation through the management of interest rates and bank reserves. An increase in interest rates, for example, reduces the amount of money in circulation and helps contain inflation.

Rising prices affect the purchasing power of households, reducing their ability to consume goods and services. In addition, businesses may experience increased operating costs, which in turn can reduce profit margins and limit investment.

In financial markets, rising prices affect real investment returns. Investors tend to move toward assets that are considered safe, such as gold or real estate, in times of high inflation. In addition, inflation expectations influence long-term interest rates and corporate investment strategies.

Leave a Reply