Produced by Michael Maloney, this documentary uncovers the mysteries behind the global financial system, exploring the history of money, the workings of central banks, and the economic cycles that led to the fall of empires. In a 10-episode journey from past to present, Maloney shows how the current fiat-based system is vulnerable to financial crises and uncontrolled inflation.

Note the words in the title “hidden secrets”: a secret in itself is something hidden, but here the concept is emphasized. In reality they are not real secrets, all the information contained is public knowledge, but almost no one knows about it because children in public schools have never been taught the basics of the financial system.

At the moment the documentary is only available in English, but it is possible to activate automatic subtitles in Italian. If the contents interest you, I can recommend reading the book Guide to Investing in Gold & Silver, also by Michael Maloney.

Disclaimer:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

Contents

#1. Money vs Currency

Michael Maloney explores the difference between “money” and “currency”. He explains that money is a store of value that is stable over time, while currency is a medium of exchange that can lose value due to inflation. He points out that fiat currencies, not backed by tangible assets, are subject to devaluation.

The video analyzes the history of monetary systems and warns of the risks associated with the current global financial system. Finally, it suggests investing in precious metals such as gold and silver to protect your wealth.

#2. USA’s Seven Stages of Empire

Michael Maloney analyzes the seven stages that empires go through in terms of their monetary system. He illustrates how nations start with a hard currency, often based on precious metals, and gradually move to fiat currencies through the expansion of credit and the increase of debt. This process leads to a loss of confidence in the currency, inflation, and, ultimately, economic collapse.

Finally, he compares these stages with historical examples, suggesting that the United States is in the final stages of this cycle. He recommends protecting one’s wealth by investing in tangible assets such as gold and silver.

#3. Death of US Dollar Standard

Michael Maloney analyzes the decline of the current monetary system based on the US dollar. He highlights how various countries are reducing their dependence on the dollar through bilateral agreements and repatriating their gold reserves.

He argues that the “Dollar Standard” system is showing signs of breaking down and predicts that it could collapse in the next decade. Finally, he stresses the importance of understanding these changes to protect your wealth.

#4. The Biggest Scam to Mankind

Michael Maloney delves into the workings of fractional reserve banking and the role of central banks. He explains how banks create money out of thin air by making loans, increasing the money supply, and creating debt. He points out that this system inevitably leads to boom-bust cycles, causing economic instability.

The video highlights how inflation erodes the purchasing power of citizens and benefits those who are closest to the source of the new money. Finally, it concludes by suggesting the importance of owning tangible assets, such as gold and silver, to protect oneself from the negative effects of this system.

#5. Where Does Money Come From?

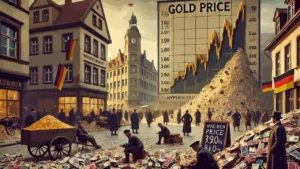

Michael Maloney examines how the corruption of money can lead to economic and social crises. Through a journey through the Bundesbank’s Geldmuseum in Germany, he traces the history of money, highlighting the transition from commodity-based currencies to fiat currencies.

It emphasizes that currency devaluation, caused by excessive issuance, can lead to dangerous deficits, debt disasters, and, in extreme cases, the rise of dictators. The video emphasizes the importance of maintaining a sound currency to ensure the stability and freedom of a society.

#6. Inflation vs Deflation

Michael Maloney explores four signs that a financial crisis more severe than 1929 is coming. He argues that initial deflation could precede significant inflation, highlighting the risks associated with central bank policies and excessive debt. The video highlights the importance of understanding these indicators to protect your wealth.

#7. USA’s Day of Reckoning

Michael Maloney examines the velocity of money, an often overlooked concept that measures the frequency with which a single monetary unit is used to purchase goods and services within a given period. He points out that a decrease in the velocity of money can indicate economic stagnation, while an increase can lead to inflation. Through historical analysis, he highlights how changes in the velocity of money have preceded significant economic crises.

The video warns that if confidence in the US dollar declines, there could be a rapid increase in money velocity, leading to uncontrolled inflation and a potential economic crisis in the United States. Finally, it suggests closely monitoring this indicator and considering investments in tangible assets such as gold and silver to protect against possible economic turbulence.

#8. From Bitcoin to HBAR

Michael Maloney explores the evolution of distributed ledger technologies, from Bitcoin to more advanced solutions such as Hedera Hashgraph. He analyzes how these innovations can radically transform global financial systems, offering greater efficiency, security and decentralization.

Finally, it highlights the potential of these technologies to replace many of Wall Street’s traditional functions and provide alternatives to certain government functions. The video emphasizes the importance of understanding and adopting these emerging technologies to promote greater freedom and prosperity globally.

Attention:

At first glance, one might think that Michael Maloney supports Bitcoin or some other specific cryptocurrency. In reality, the author tends to valorize the technology, whatever it is, that allows information or values to be transacted in the most decentralized, secure and efficient way possible.

#9. Fall of Empires: Rome vs USA

Michael Maloney explores the similarities between the fall of the Roman Empire and the current situation in the United States. He highlights how poor monetary policies and inadequate leadership have led to the decline of great civilizations, suggesting that the United States may be on a similar trajectory. The video raises questions about the ability of the president and the Federal Reserve to prevent an economic crisis through extreme intervention.

#10. American Bread & Circus

Michael Maloney delves into the concept of “panem et circenses,” used in ancient Rome to distract the population through food distributions and entertainment, diverting attention from political and economic problems. He draws a parallel to contemporary American society, suggesting that government welfare programs and the entertainment industry play a similar role, keeping citizens distracted while significant economic changes occur.

The video examines how these tactics may contribute to a lack of public awareness of critical economic issues and potential impending financial crises. Finally, it urges viewers to recognize these dynamics and take steps to protect their wealth, suggesting investments in tangible assets such as gold and silver.

Leave a Reply