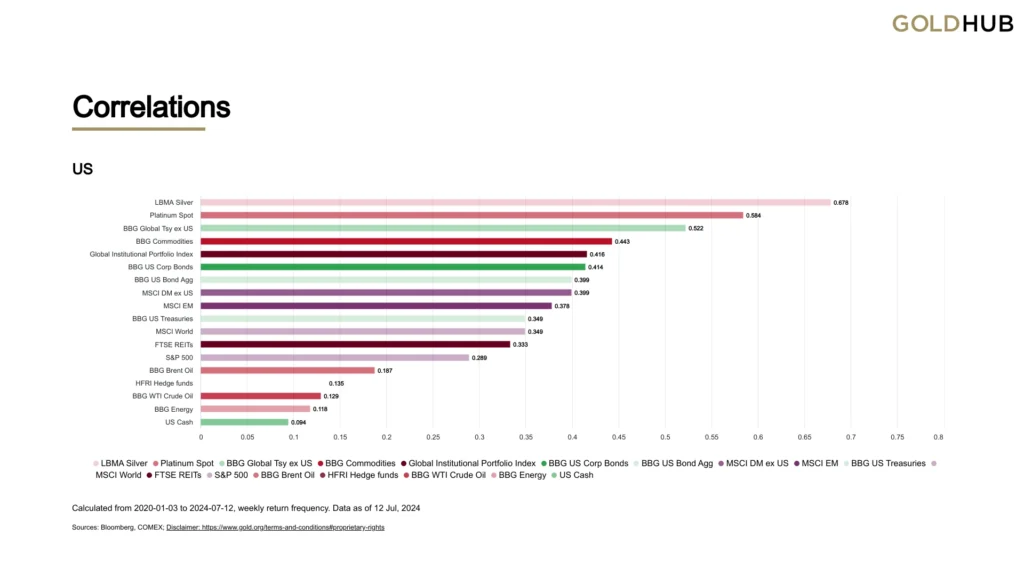

Analyzing and correlating historical data provided by the World Gold Council, it appears that the price of gold is poorly correlated with most other asset classes. However, it shows a strong affinity with other precious metals and a weaker one with raw materials in general and non-US government bonds.

Disclaimer:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

#1. What is correlation

The World Gold Council is an industry association of major gold mining companies. Its purpose is to stimulate demand for gold from industry, consumers and investors. It also provides interesting data and charts on gold, which I have taken inspiration from.

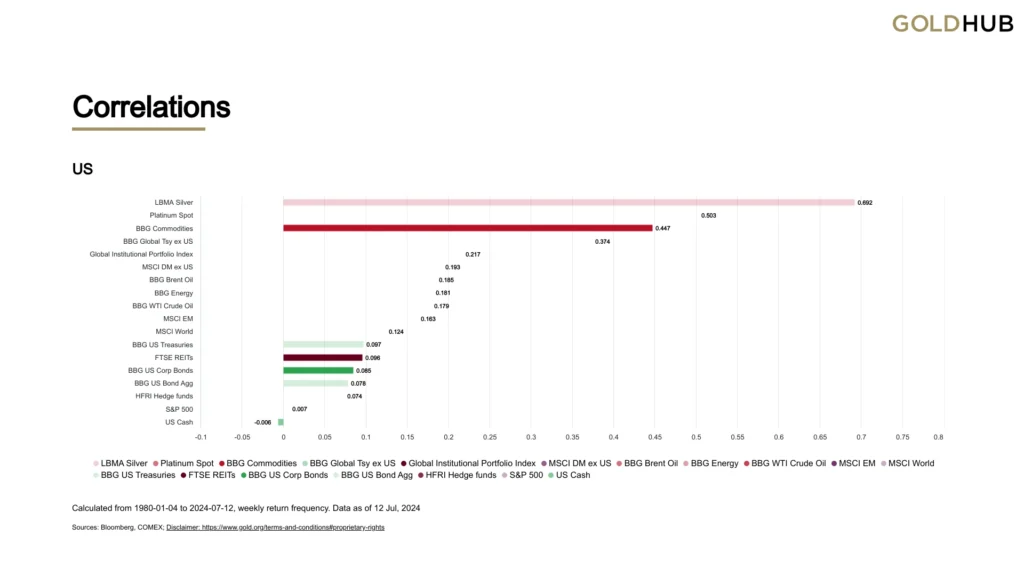

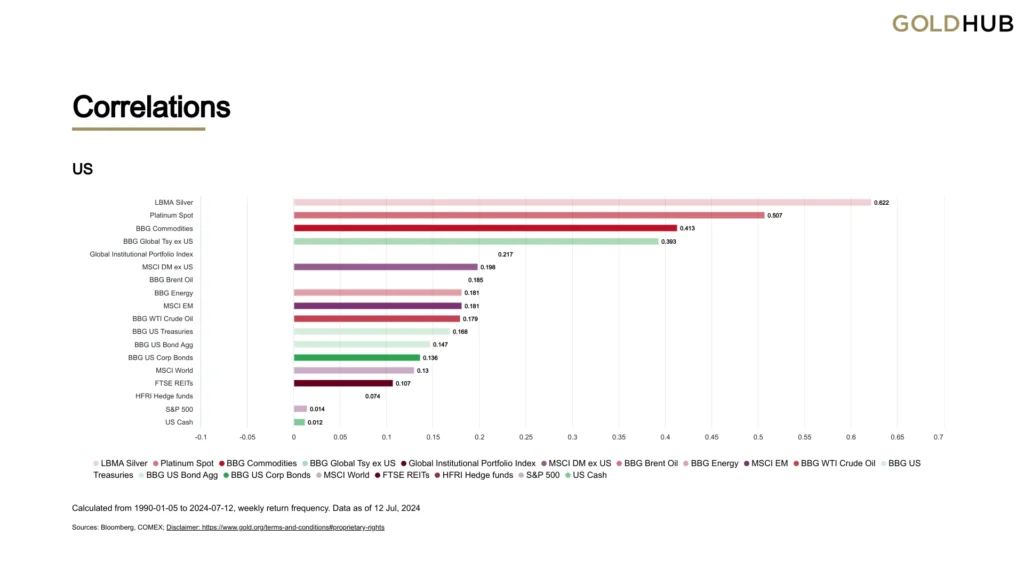

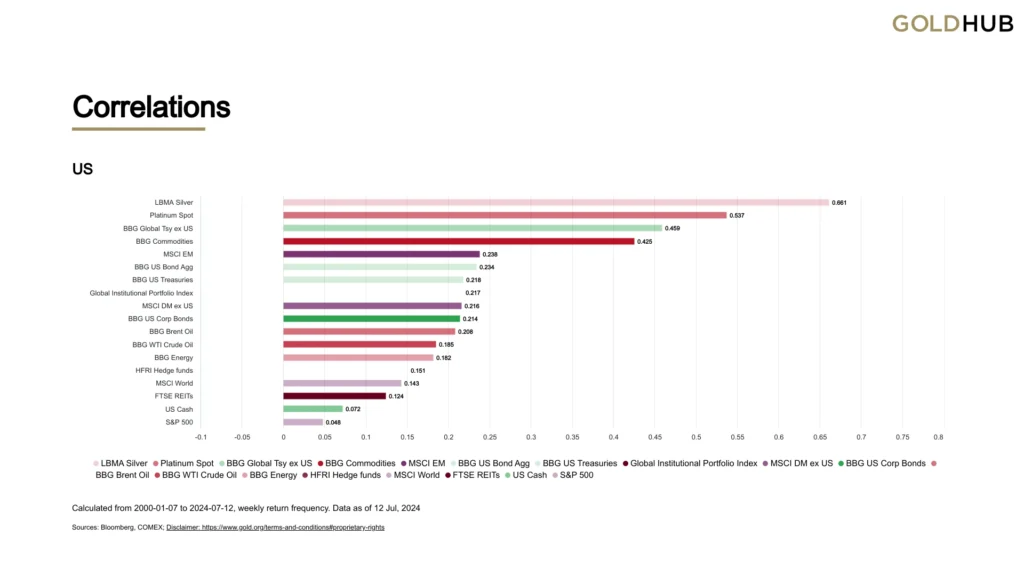

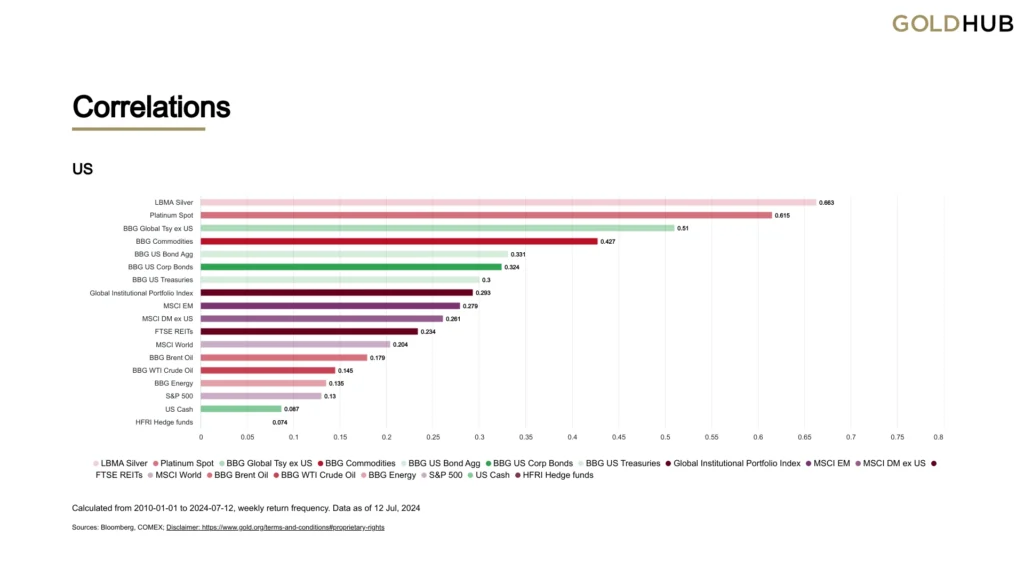

All the data and graphs in this article were taken from this web page , always made available by the World Gold Council. So let’s start from the year 1970 and go forward decade by decade to understand how gold has been correlated to other investment classes over time.

Correlation is measured with a parameter ranging from -1 to +1.

- A value close to -1 indicates a strong inverse correlation: as one increases, the other decreases and vice versa.

- A value close to 0 indicates a total absence of correlation: as one increases or decreases, the other can move in any direction without predictability.

- A value close to +1 indicates a strong direct correlation: as one increases, the other also increases and vice versa.

#2. Gold correlation over time

Summarizing the graphs above we can summarize that:

- 1970-2024: A fairly strong correlation with silver and a lukewarm one with commodities in general.

- 1980-2024: as before.

- 1990-2024: As before, but a strong correlation with platinum comes into play and a more tepid one with non-US government bonds.

- 2000-2024: as before.

- 2010-2024: As before, but correlation with US government and corporate bonds increases slightly.

- 2020-202: as before, but the correlation with global equity (weighted by capitalization) and US general bond markets increases visibly.

Based on the data just shown, I feel fairly confident in saying that gold has a strong correlation with other precious metals, a more tepid correlation with commodities in general and non-US government bonds, and a weak correlation with global equity and non-US bonds, but only in the short term. No particular correlation, however, with anything else.

Leave a Reply