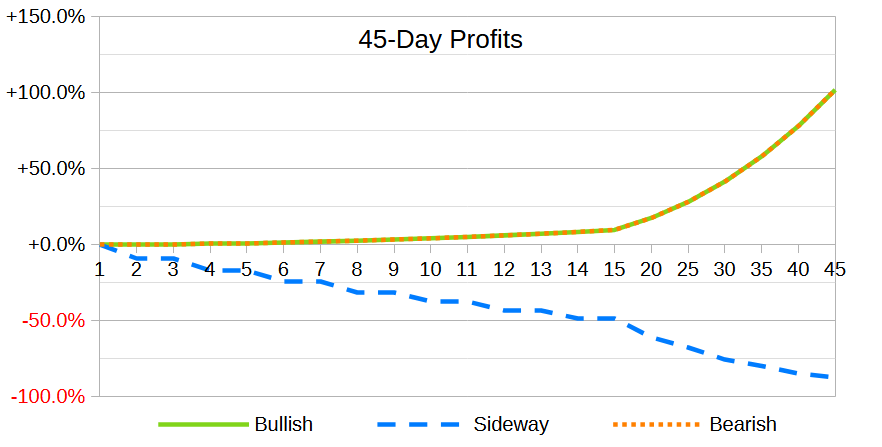

There is a relatively safe method to make a decent profit from both a bullish and a bearish scenario. The important thing is that the trend does not sideways for too long and that its oscillations are as limited as possible.

In order not to complicate the reading of the results, the costs for opening and maintaining leveraged positions have not been included. They involve an expense proportional to the amount borrowed and its duration. It would be advisable to use leverage only for the short or very short term.

Disclaimer:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

Contents

- (00:00) Introduction

- (04:29) Instructions

- (09:22) No leverage

- (10:53) Full leverage

- (12:35) Partial leverage

- (15:04) Conclusions

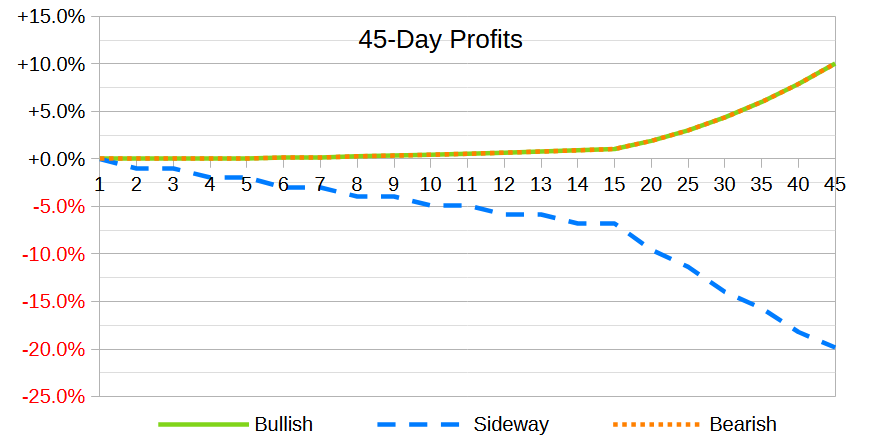

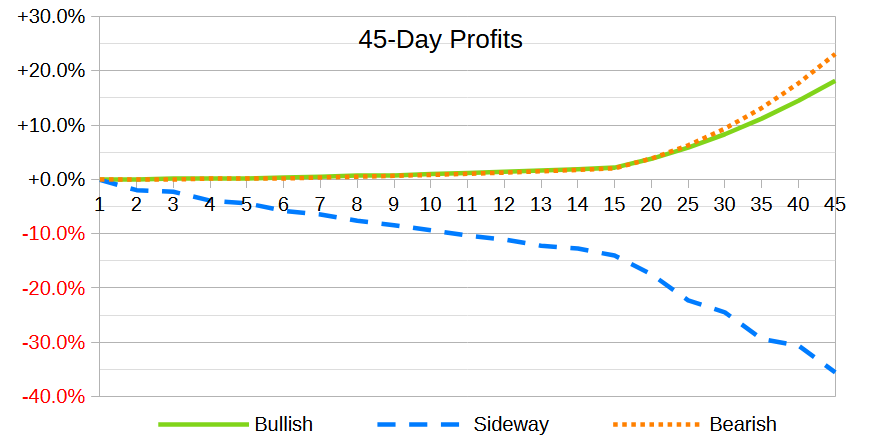

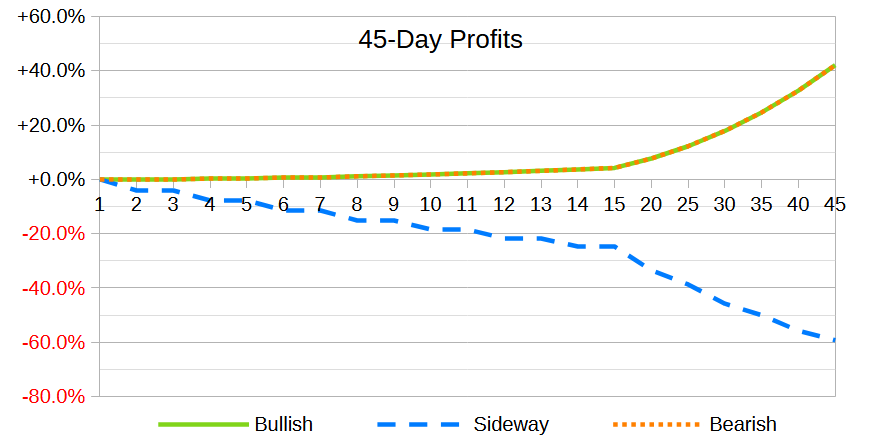

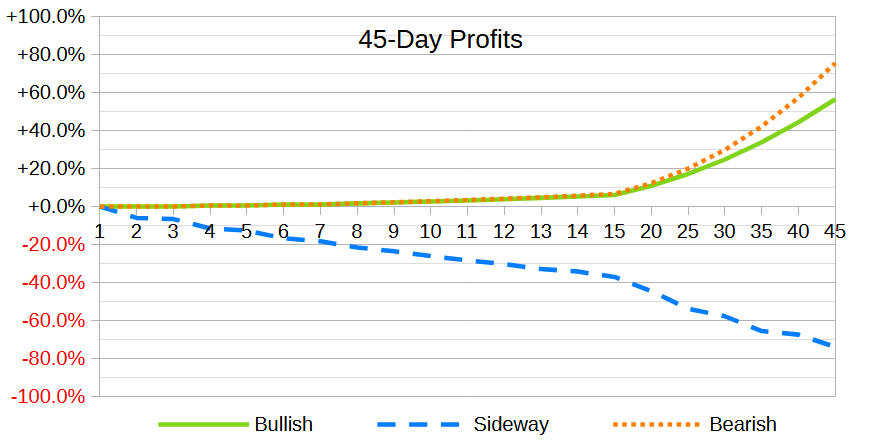

Examples of 45-day profit with balanced leverage applied on a simplified daily variation: bullish at +1%, sideways at ±10% and bearish at -1%.

Choosing unequally balanced levers better appreciates the performance associated with the stronger lever at a later time.

| Cautious scenario (No Leverage) | Moderate Scenario (Partial Leverage) | Aggressive scenario (Full lever) | |

|---|---|---|---|

| Leverage and (Weight) | 1x (50%) vs. -1x (50%) | 1x (67%) vs. -2x (33%), 1x (75%) vs. -3x (25%) | 2x (50%) vs. -2x (50%), 2x (60%) vs. -3x (40%), 3x (50%) vs. -3x (50%) |

| Suitable for lateralization risk | Moderate | Low | Almost zero |

| Suitable for positive or negative trend | Weak | Moderate | Strong |

If you want to customize the simulation according to your parameters, you can use this spreadsheet, the same one I used to process the data above:

Leave a Reply