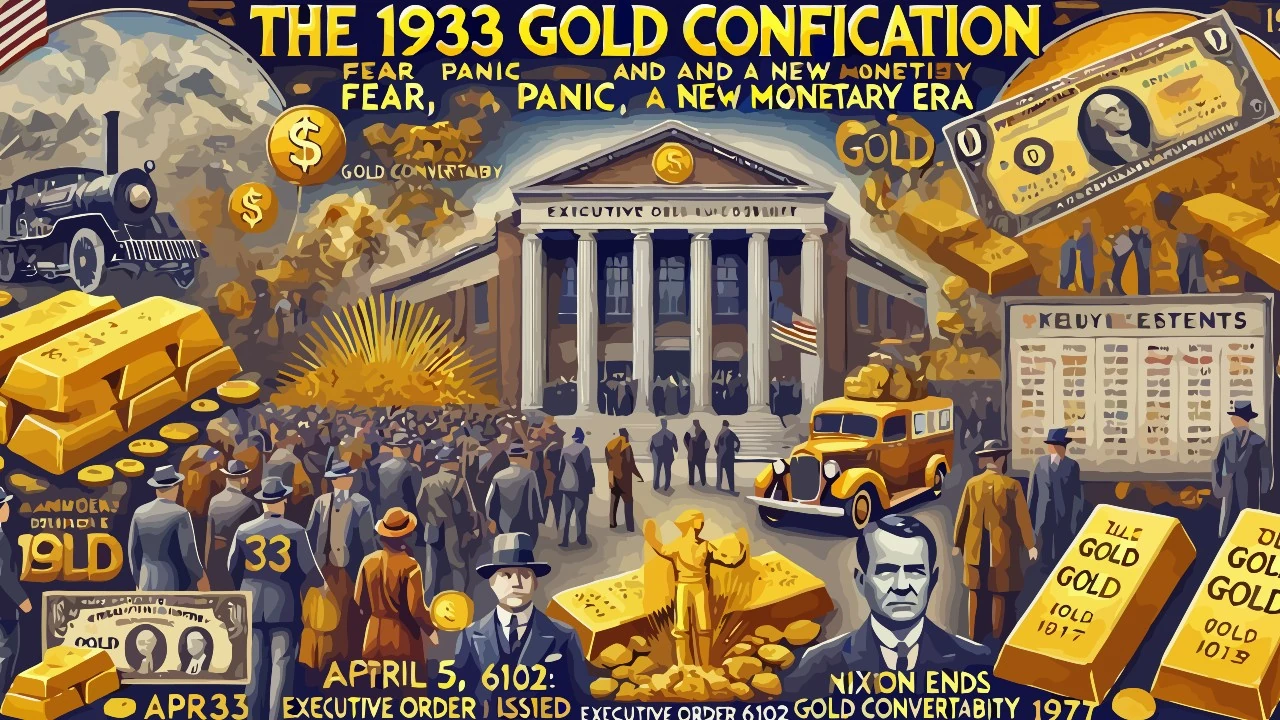

In 1933, in the midst of the Great Depression, President Franklin D. Roosevelt issued an executive order requiring American citizens to turn over their gold to the government. This is often described as a “seizure,” but the reality is more complex.

Contents

#1. What was Executive Order 6102

Executive Order 6102, signed by Franklin D. Roosevelt on April 5, 1933, required U.S. citizens to turn over gold coins, bullion, and certificates to the Federal Reserve, in exchange for dollars at a fixed rate of $20.67 per ounce. The rule did not include gold jewelry, which remained the free property of citizens. However, violators could be fined up to $10,000 or imprisoned for up to ten years.

Despite the strict regulations, there were some exceptions: private citizens could retain up to $100 in gold coins (about 5 ounces, or 155 grams). In addition, industrial, numismatic, and ornamental uses were exempted, allowing jewelers and collectors to continue to own gold in certain forms.

The stated purpose of the order was to stabilize the economic system, which was suffering from deflation and a banking crisis. With the Gold Standard still in place, the value of the dollar was tied to gold, and the tendency of the population to withdraw physical gold from banks was creating a dangerous contraction of the currency in circulation.

The measure remained in effect until December 31, 1974, when President Gerald Ford revoked the ban, restoring citizens the freedom to own gold without restriction.

#2. Today’s perception

The order is still a matter of debate today. Some see it as a necessary measure to address the economic emergency, while others consider it a serious violation of individual freedom.

Economically, the order allowed the government to avoid the collapse of the banking system, preventing a gold rush that would have paralyzed credit and deepened the recession. It also facilitated the abandonment of the gold standard, a step considered crucial to reviving economic growth.

However, not everyone shares this view. For many critics, the order was a forced expropriation of citizens’ assets, who were deprived of a safe haven just when inflation threatened their purchasing power. Most controversially, immediately after the confiscation, the government raised the price of gold to $35 an ounce, devaluing the dollar by 70% and generating a direct benefit for the federal coffers at the expense of citizens.

Another controversial aspect is the length of the ban. Although the order was introduced as an emergency measure, it remained in effect for over forty years, until Gerald Ford revoked it in 1974, once again allowing citizens to freely purchase and hold gold.

#3. The reality of the facts

A widespread misconception today is that the U.S. government used law enforcement or the military to enter citizens’ homes and seize gold by force. In reality, the measure was enforced primarily through the banking system.

The government relied on the voluntary cooperation of citizens, who had to go to banks and government offices to hand over their gold. Information campaigns of the time emphasized patriotic duty and the need to contribute to the economic recovery of the country.

Although severe penalties were foreseen for those who did not respect the order, there were few complaints and the government did not carry out mass searches. Most of the population complied with the rule without particular resistance, also because the circulation of gold coins was already in decline.

Some citizens attempted to circumvent the law by holding gold privately or moving it abroad, but the government did not conduct a large-scale gold hunt. The real pressure came from the impossibility of using gold in official circuits: those who did not hand it over, in effect, found themselves with an asset that was no longer spendable.

#4. Why it can’t happen again today

The main purpose of Executive Order 6102 was to devalue the dollar to facilitate economic recovery. After collecting the gold, the government increased its official value from $20.67 to $35 per ounce, thus devaluing the currency by 70%.

In 1933, the monetary system was tied to the Gold Standard, which meant that every unit of money issued had to be backed by a fixed amount of gold. The problem was that, due to the crisis, citizens were privately hoarding gold, reducing the amount available in federal reserves and making it difficult to expand the money supply .

By eliminating private ownership of gold, the government could revalue its reserves and increase the monetary base without the risk of a bank run. This allowed more money to be pumped into the economy, countering deflation and encouraging investment.

Today, the government no longer needs such measures. With the end of the Gold Standard in 1971, the currency is no longer tied to gold and the value of the dollar is regulated by the monetary policy of the Federal Reserve. This means that the government can expand the money supply by printing more money or changing interest rates, without having to seize gold reserves from citizens.

However, this flexibility also has its risks. If in 1933 the danger was deflation, today the main problem is the risk of uncontrolled inflation, caused by excess liquidity in the economic system.

Leave a Reply