Let’s compare the performance of gold with that of fixed-rate bonds and the S&P 500 index. Gold, although it does not provide dividends or coupons, is a good way to protect your capital over time without running any counterparty risk.

All the returns reported below are not burdened by any reductions due to the taxation of coupons and dividends or management costs.

Disclaimer:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

#1. Returns compared

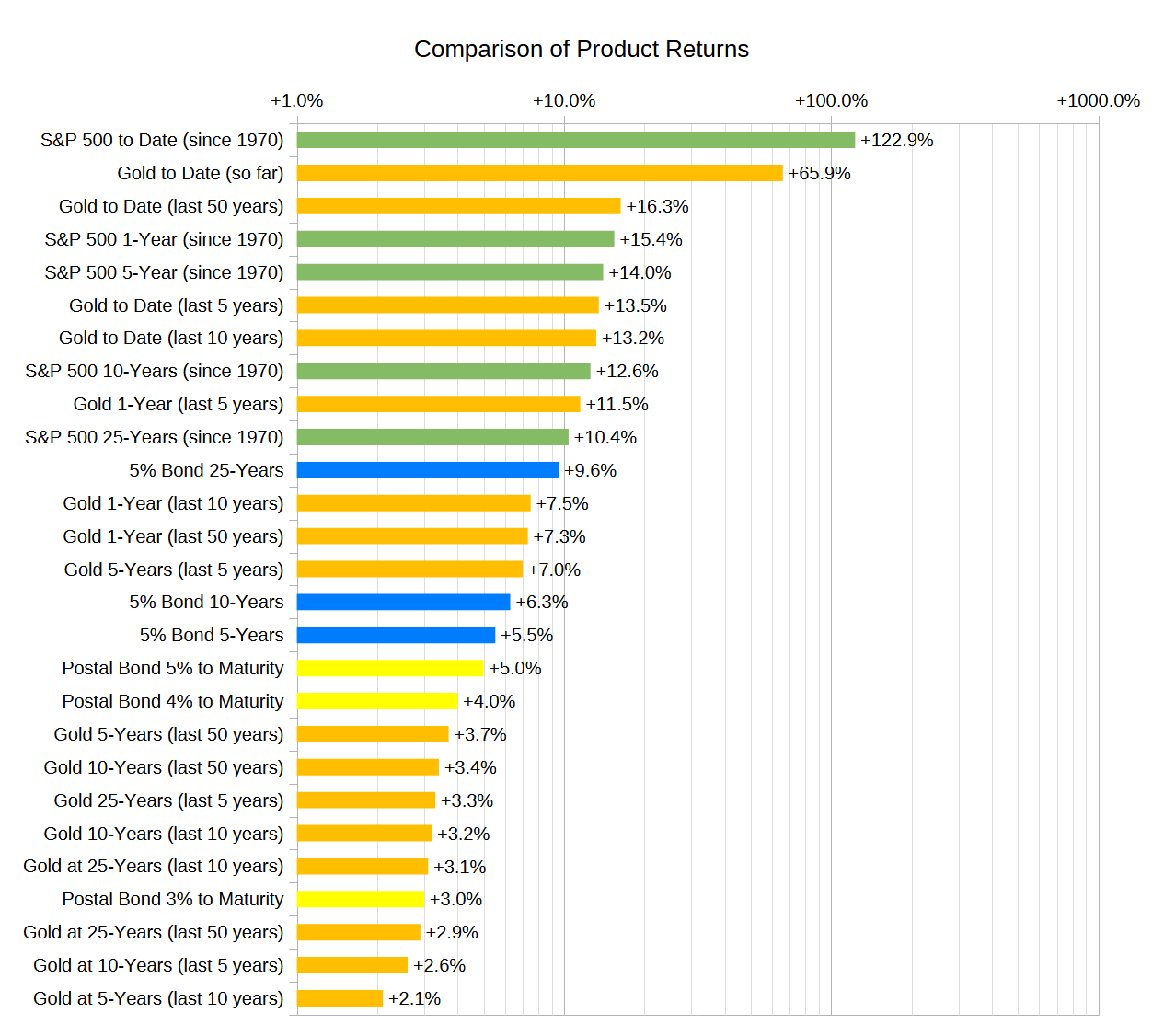

By processing historical data on the price of gold, hypothetical fixed-rate bonds and the S&P 500 we can obtain an estimate of the returns of the major representatives of the three main investment classes: commodities, bonds and stocks.

Comparing the data we can deduce the following:

- S&P 500: reference standard for stock markets, it is confirmed as the best performing financial product, with average annual returns ranging between 10-15%. From its launch to today it has returned an average of 123% per year.

- Good return bonds: with annual coupons of 5% reinvested, they return an average of between 5-10% each year. It is understood that the price of these bonds does not vary over time and that they are reimbursed at maturity.

- Gold: starts from a solid base of average annual return of 3% that can rise to average values of 7-11.5% in favorable moments. From when we have available prices to today, gold has returned an average of 66% per year.

#2. When gold outperforms stocks

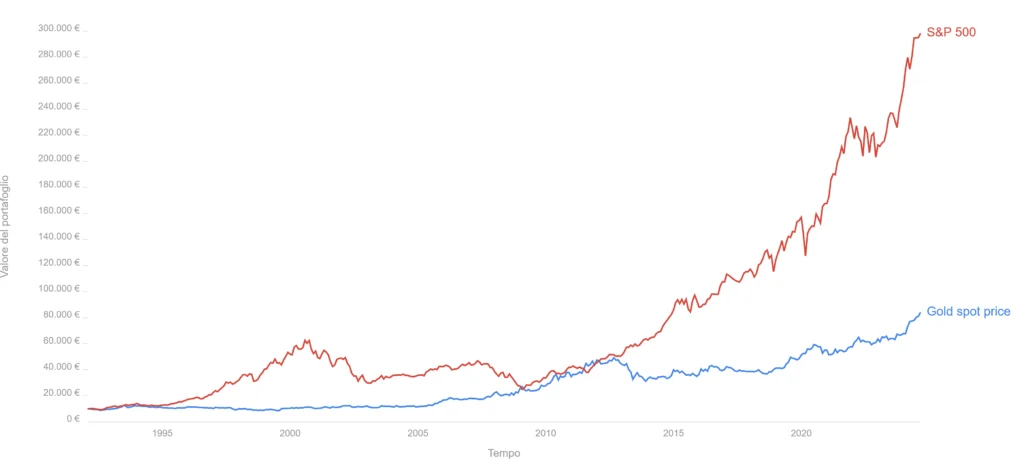

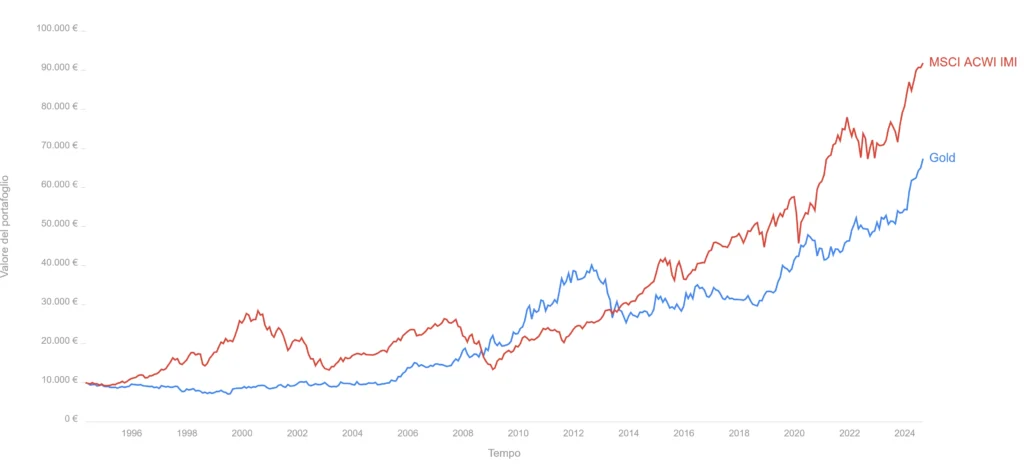

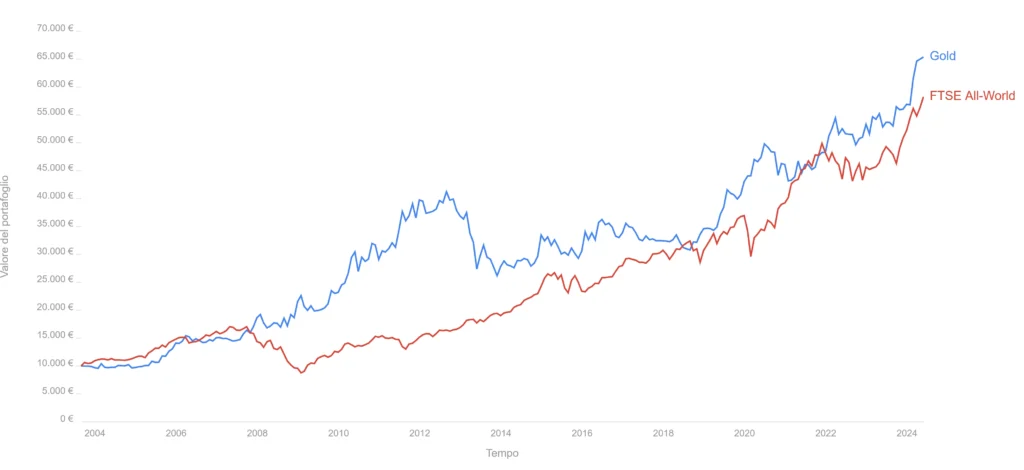

Sometimes gold can even outperform stocks. In this regard, I decided to compare the price of gold with that of the S&P 500 (the benchmark stock) and with global stock indices. The result could be surprising to some:

When stocks outperform gold

Before the 2000s, before the big dot-com and real estate bubbles, stocks outperformed gold. Gold was still recovering from the bubble peak in 1980.

When gold outperforms stocks

Since the 2000s, gold, having almost completely recovered from its bubble, has performed better than stocks that faced the two large bubbles mentioned above.

#3. Summary analysis

Tge best earnings ever are undoubtedly achieved with stocks, in any case gold has a series of advantages:

- More than decent returns,

- Decorrelation from other investment classes,

- No counterparty risk,

- No mandatory securities deposit,

- It can be kept by oneself in total autonomy and anonymity.

Unfortunately, however, gold has shown over time a volatility almost equal to that of stocks, which could discourage investors not willing to take the same risk in exchange for lower average returns.

👉 Read also: Gold Price and Returns Over Time 📊

Furthermore, those 30 years in which gold did not touch its highs certainly do not make it easy for the doubtful investor to change his mind. However, I believe that moment is unlikely to repeat itself and I have already explained why…

👉 Read also: Today, Compared to the Last Gold Rush of the 70s…

Sources and data:

Leave a Reply