Let’s try to understand what Government Bonds are and analyze them together.

I will be quite critical. Not because I only want to speak badly of them, but because they are often only spoken of well and I would like to compensate for this imbalance in common perception by showing aspects that perhaps were not known or were thought to be false.

At the end of this article, I will not advise against buying a Government Bond regardless, in fact in some cases it can be a reasonably sensible choice.

Disclaimer:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

Contents

#1. The only good thing is the name

They are called Government Bonds but their real name should be:

I, the State, have failed to pay my debts or have spent more than I have collected. Therefore, I need more money, even from those who have already given it to me before, even if I have not been able to use it profitably.

Notice how the music changes, right?

Because that’s exactly how it is: every time a government issues its own bond, it means it’s looking for money to pay off its previous debts that it hasn’t been able to pay or it’s unable to balance its books.

Imagine a company that has been forced to continually issue bonds for centuries to avoid going out of business and is almost never able to distribute dividends to investors… and despite this, people continue to lend it money because it has a privileged line of credit.

This is a mechanism that has been going on for many years. Although the so-called “safe” government bonds (i.e. issued by countries that have received a reliability rating) have practically always been paid, this doesn’t mean that they will continue to be so in the future.

Of course, the “failure” of a reliable government is a very unlikely eventuality, but still possible.

It should also be remembered that over an overall time horizon, the trend of a government’s public debt is always increasing. An ever-increasing public debt can only be repaid with new government bonds that attract ever more investments.

The real problem of the growing public debt, however, is not so much its increase, but the increase in the related interests that must be constantly paid through cuts in public spending or with the issuance of new public debt.

In short: it is like a dog chasing its own tail that is getting shorter and shorter.

#2. In the end they are bonds

When you buy a government bond, you are simply buying a bond issued by the government rather than a company. As a bond, it replicates virtually all the buying and selling mechanics of corporate bonds.

Sell before expiration

If you need the money you invested in a government bond before its natural maturity, the only way you can sell it is to do so on the secondary market, i.e. on the stock exchange.

However, this sale does not guarantee that you will be able to fully recover the invested capital. In fact, depending on the trend of the interest rates decided by the central bank and the liquidity available to the bond in question, you could lose a significant percentage of your investment.

The change in interest rates

Almost all government bonds are issued with a fixed interest rate (coupon).

- If the interest rates of government bonds issued subsequently were to increase, your government bond would automatically lose value because it would be less convenient to buy. In fact, new government bonds with a higher interest rate would attract more investors.

- If the interest rates of government bonds issued subsequently were to decrease, your government bond would automatically increase in value because it would be more convenient to buy. In fact, new government bonds with a lower interest rate would attract less investors.

The role of liquidity in the stock market

As mentioned above, the total reimbursement of the amount invested in a Government Bond occurs upon its maturity. If we want to sell it before its natural maturity, we can do so on the secondary market, i.e. on the stock exchange

When you sell a financial product on the stock exchange, there are not necessarily enough purchase orders to allow the sale at the current price. In essence, the more quantities you sell, the more buyers you will need to allow you to liquidate your Government Bond at the best price. An additional problem to liquidity could also be the lack of interest from buyers in the Government Bond in question for various reasons, including the one mentioned in the previous point.

We have understood that Government Bonds do not enjoy particular privileges compared to corporate bonds, apart from the intrinsic “guarantee” of being issued by a State rather than a company.

#3. They are not 100% safe

There are people who invest a good part or all of their savings in government bonds. The false sense of security that leads them to make this choice comes from false beliefs, let’s dismantle them point by point:

The State can “defaults”!

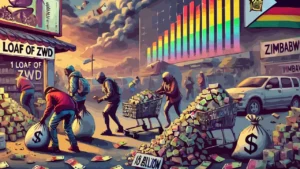

As explained before, even States can “defaults”! This is a very remote possibility, especially if the States belong to developed countries but history is full of States that have defaulted totally or partially because they could no longer repay their debts.

Here is a list of States that have defaulted (including unsuspected countries).

They are not free from risks

Personally, I would advise against investing in Government Bonds in the medium or long term to avoid as much as possible problems of insolvency by the issuer or having to need your money at a time when the change in interest rates by the central bank has changed their value on the secondary market (the stock exchange).

A further negative hypothesis could be the restructuring of the debt, a nice word that becomes less nice in its operation, which would mean the modification or loss of some advantage for the holders of Government Bonds such as: extension of the maturity, modification of the frequency of the coupon, alteration of the value of the coupon, reduction of the nominal value at maturity. If you were wondering if this has already happened in Europe, well yes, in 2012 it happened in Greece and more recently something similar also in San Marino!

The implementation of this procedure subsequently became regular through the introduction of CACs (Collective Action Clauses) which have progressively become an integral part of the ESM (European Stability Mechanism) since 1 January 2013.

Profit can be an illusion

The profit almost always comes from the periodic distribution of coupons to the holders, but its meaning varies depending on the perspective from which you look at it.

If inflation or the devaluation of the reference currency is greater than the revaluation of the invested capital received in the form of coupons, you will certainly have more money than before but it will still be worth less.

#4. Self-guarded public debt

How many times have we heard that “if public debt were in the hands of its citizens” it would be better for the country? Personally, I consider this statement neutral, neither true nor false.

Public debt not in the hands of citizens

So in the hands of fund management companies, corporations, multinationals, other states or citizens of other states.

The positive aspect is that a wider range of buyers means a greater probability of remaining solvent and being able to repay the previous debt. At the same time it also means being able to issue new debt at relatively low interest rates: more public means more demand and therefore easier to find buyers at lower rates.

The negative aspect is that the money tends to leave the country and would only return if the same beneficiaries reinvested in the country itself or subsequently bought back the government bonds.

However, it must be remembered that a sovereign state of its own currency could print more money to buy back its own debt in the event of a shortage of buyers (or to keep interest rates low), which would devalue the currency… which always devalues over time in any case.

Public debt in the hands of citizens

The good thing is that the interest money (coupons) circulates within the country itself. In Italy alone, we are talking about 100 billion euros per year.

The bad thing, in addition to a smaller audience of buyers, is that it becomes less complicated to renegotiate the debt (restructure it, see CACs in Europe) when most of it is held by “normal” people instead of elites.

You’re not naive enough to believe we live in a democracy, are you Buddy?

Gordon Jekko, Wall Street (1987)

Furthermore, if a state’s debt were mostly held by its citizens, a vicious circle would be created in which no citizen would want the debt to be cancelled because this would mean losing the money invested in it. A mechanism very similar to blackmail or an offer that cannot be refused.

#5. The failure of a state in practice

The bankruptcy of a state (or rather the default on its debt) seems like a scary and complicated event, but in the end it is relatively quiet and simple.

If I want to exaggerate, it makes me imagine catastrophic consequences such as: volcanoes erupting, lava in the streets, forests on fire, floods, collapsing buildings and people running in every direction screaming at the top of their lungs in despair.

In reality, what would happen would be that the holders of government bonds, therefore the creditors of the state, would stop receiving interest and would not receive repayment of the loan. In the best of cases, they would only lose a part of the loan. That’s it. Nothing more.

#6. Target audience

In conclusion, I consider government bonds to be a more efficient instrument than postal savings bonds, but also with more constraints.

I would recommend them to anyone who wants to invest in the safest way possible a sum that they will not have to use for a little more than 5/6 years, with relatively low and safe interest rates.

They are just useful for earning something, nothing more. Because when you start earning much more than something, the related risk is probably starting to rise.

However, I always recommend caution. Don’t be fooled by the certainty of a coupon.

Leave a Reply