Fiat money, or money not backed by a physical asset such as gold, has become the linchpin of the modern economy. Although often criticized for its lack of intrinsic value, it remains a central tool in the functioning of global economies.

Don’t get me wrong, this is not an article in favor of fiat money, in fact I would be more inclined towards a currency with an underlying. But I want to point out that, for better or for worse, there is worse and it is possible to protect oneself from its devaluation by acting with financial awareness.

Contents

#1. Indifference to an underlying

One of the main arguments against fiat money is its lack of a link to tangible reserves, such as gold. However, this criticism seems to have less and less weight among ordinary people and investors. Trust in money today is built primarily on the stability of financial institutions and the economic strength of the governments that issue it.

The new generations, in particular, who grew up in a context where digital money is predominant, consider fiat money simply as a tool of exchange and a store of value. The perception of money has evolved: instead of wondering if a banknote is backed by gold, most people ask themselves if an economic system is able to guarantee services, goods and financial security.

Furthermore, the very idea of using a physical underlying such as gold is seen by many economists as limiting. Flexibility, one of the major strengths of fiat money, allows governments to react quickly to economic crises, which would be impossible in a system based on a rigid and limited underlying.

#2. Fiat as a tool of governments

Fiat money gives governments unprecedented control over economic policy. Through tools such as printing money and managing interest rates, governments can move liquidity where it is most needed, such as to stimulate the economy during a recession or to finance essential infrastructure. But this flexibility comes with costs, such as rising government debt and the risk of inflation.

A recent example is the measures taken during the COVID-19 “pandemic.” Governments around the world issued large amounts of money to support affected economies, distributing direct aid to citizens and financing support programs. These actions, while generating inflation, prevented the collapse of many economic sectors and safeguarded millions of jobs.

However, the use of fiat money is not without its critics. Rising government debt is a chronic problem for many advanced economies. Opponents argue that over-reliance on money printing can lead to uncontrollable inflationary cycles. Despite this, governments continue to prefer this system for its ability to respond quickly to macroeconomic needs.

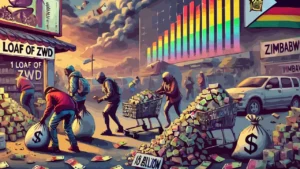

#3. Opportunities in devaluation

An often overlooked aspect of fiat money is that its devaluation can create opportunities for profit. The loss of value of money, due to inflation, drives many people to look for ways to protect their wealth. This phenomenon incentivizes investments in financial markets, safe havens like gold, and even (or sadly) digital assets like cryptocurrencies.

Investors can take advantage of currency devaluation by turning it into an opportunity to generate wealth. For example, a well-diversified portfolio in stocks, bonds, and commodities tends to perform better in times of inflation. At the same time, more conservative investors can choose gold, which has historically proven to maintain its value or even increase during times of economic instability.

Inflation, then, is not always an unmitigated evil. While it reduces the purchasing power of money, it also stimulates financial innovation and encourages people to educate themselves about economics , pushing them to explore new opportunities to protect or grow their wealth.

#4. The role of gold in BRICS+

As the fiat currency system continues to dominate globally, rumors are emerging about a possible reintroduction of a gold underlying in some international trade, particularly among the BRICS+ bloc countries (Brazil, Russia, India, China, South Africa and others who joined later). This proposal arises from the desire to reduce dependence on the US dollar and create a more balanced system that is less vulnerable to the decisions of a single country or economic bloc.

The idea of a gold underlying for international transactions is attractive to many, as it promises greater stability and confidence in the markets. However, there are also numerous obstacles. For example, the value of gold is subject to fluctuations and its distribution is limited, which could create disparities between participating countries.

At the moment, this hypothesis remains only a proposal and it is not clear whether it will materialize. However, the fact that it is being discussed shows that the debate on the nature of money is far from over and that the global economic structure could undergo further transformations in the coming years.

Leave a Reply