Gold and silver prices alone are not enough indicators to give us an idea whether they are undervalued or overvalued. We can only compare them to previous prices, but nothing more. To have a better understanding we need some indicators.

Disclaimer:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

Contents

#1. Introduction

The mathematical indicators used to analyze the price of precious metals are essential tools for understanding how the value of these assets moves over time and in relation to other assets. These indicators allow us to evaluate the price trend in different economic contexts, providing investors with useful information for making strategic decisions.

By analyzing correlations with commodities, currencies, and stock markets, you can spot market trends, recognize moments of economic instability, and identify investment opportunities. Understanding these tools provides a more complete and accurate view of price developments and the effectiveness of precious metals as a store of value or hedge against inflation.

#2. Gold/Silver ratio

The Gold/Silver Ratio is one of the oldest and most significant indicators for analyzing the value relationship between gold and silver. Its origin dates back to ancient Rome, when the ratio between the two metals was set by law at about 12 to 1, meaning 12 ounces of silver were needed to buy one ounce of gold. Over the centuries, this ratio has undergone numerous fluctuations, reflecting economic changes and market dynamics.

The indicator is particularly useful for investors and financial analysts because it provides an immediate overview of the relative cheapness of the two precious metals. When the ratio is high, it means that silver is relatively undervalued compared to gold, potentially suggesting a buying opportunity in silver. Conversely, a low ratio indicates that gold is cheaper in relative terms.

The main reason for using this indicator is to assess the attractiveness of one of the two metals compared to the other, especially in times of economic uncertainty or inflation. Since gold is considered a safe haven and silver also has a strong industrial component, their ratio can provide useful information on both market expectations and investor sentiment.

To calculate the Gold/Silver Ratio, the current price of gold is divided by the current price of silver, resulting in a number that indicates how many ounces of silver are needed to purchase one ounce of gold. This value is constantly monitored by financial markets, as it varies depending on global economic conditions, monetary policy decisions, and industrial demand for silver.

Historically, the ratio has fluctuated considerably: during the 19th century, it hovered around 15:1, while in recent decades it has reached peaks of over 100:1 during financial crises. These variations reflect how silver, more volatile than gold, undergoes greater fluctuations in response to economic and industrial conditions. Correctly interpreting the Gold/Silver Ratio allows you to adopt targeted investment strategies and balance your portfolio efficiently, taking advantage of the opportunities offered by market fluctuations.

#3. /Oil ratio

The Gold/Oil Ratio and the Silver/Oil Ratio are indicators used to compare the value of precious metals relative to the price of oil. Their history dates back to the 1970s, when the global energy crisis led analysts to look for correlations between strategic raw materials. These indicators provide a measure of the purchasing power of precious metals in terms of barrels of oil, offering a perspective on the relative value between safe havens and energy resources.

The main reason for using these ratios is to assess the balance between gold or silver and oil, especially in times of high inflation or economic turmoil. Gold tends to appreciate during times of financial crisis, while oil can fluctuate greatly due to geopolitical tensions or changes in global demand. As a result, the ratio of the two assets reflects the market’s perception of the economic stability and strength of the commodities.

When the Gold/Oil Ratio is high, it means that gold has greater purchasing power than oil, suggesting that the market perceives the precious metal as a safe haven. Conversely, a low ratio indicates relative strength in oil, often associated with strong industrial demand or a supply shock. The same is true for the Silver/Oil Ratio, although silver is generally more volatile and subject to larger movements than gold.

To calculate these ratios, the current price of gold or silver is divided by the price of oil, resulting in the number of barrels that can be purchased with an ounce of the precious metal. Monitoring these values allows investors to interpret economic signals and assess whether the market is favoring safe havens or energy resources.

Historically, the Gold/Oil Ratio has seen significant fluctuations: during the oil price collapse in 2020, it reached record levels, signaling a strong preference for gold. The Silver/Oil Ratio, on the other hand, also reflects the industrial component of silver, which makes it more sensitive to economic dynamics. Analyzing these indicators helps to make strategic investment decisions, balancing the portfolio between safe haven assets and raw materials.

#4. /Stock ratio

The Gold/Stock Ratio and Silver/Stock Ratio are indicators that measure the relationship between the price of precious metals and the value of a stock index, such as the S&P 500 or the Dow Jones. These ratios are essential for assessing the relative performance of gold or silver compared to the stock market, providing crucial indications of investors’ perceptions of economic stability and risk appetite.

The origin of the use of these ratios dates back to the early 20th century, when analysts began comparing the performance of gold with the evolution of stock indices to better understand economic cycles. Their main purpose is to monitor periods in which investors prefer safe haven assets, such as gold and silver, over riskier assets such as stocks.

When the Gold/Stock Ratio is high, it means that gold is outperforming stocks, usually in the context of a financial crisis or economic recession. Conversely, a low ratio indicates a market preference for stocks, often associated with a phase of economic expansion or strong investor confidence. The same principle applies to the Silver/Stock Ratio, although silver tends to be more volatile due to its dual nature as a precious and industrial metal.

These ratios are calculated by dividing the price of gold or silver by the value of the chosen stock index. The result shows how many ounces of precious metal are needed to “buy” a share of the index. This value changes frequently, reflecting the constant oscillation between confidence in the stock market and the search for safety through precious metals.

Historically, peaks in the Gold/Stock Ratio have occurred during major economic crises, such as the 2008 recession and the 2020 pandemic, while troughs have occurred during periods of strong economic growth. The Silver/Stock Ratio, on the other hand, has shown greater volatility, highlighting how silver responds more quickly to changes in industrial activity.

These indicators are useful for investors to balance portfolios strategically, identifying the moments when it is more appropriate to focus on precious metals rather than stocks. Being aware of these dynamics allows you to seize market opportunities and mitigate risks in times of economic uncertainty.

#5. /Copper ratio

The Gold/Copper Ratio and Silver/Copper Ratio are indicators that relate the price of precious metals to the price of copper, an industrial metal that is critical to manufacturing and infrastructure. These ratios offer a unique perspective on the balance between safe-haven assets and industrial commodities, reflecting the market’s perception of economic stability and global growth.

The history of these indicators dates back to the growing industrialization of the 19th century, when copper became a key metal for electrical infrastructure and construction. Gold, on the other hand, continued to be a store of value and a safe haven. Since then, comparing the price of gold and silver to copper has become an effective way to analyze market performance in relation to the real economy.

The Gold/Copper Ratio is particularly useful for assessing how the price of gold is moving relative to the value of copper. An increasing ratio indicates strong investor preference for safe-haven assets, typically signaling an economic slowdown or impending recession. Conversely, a decreasing ratio suggests an economic expansion, as copper appreciates on strong industrial demand.

The Silver/Copper Ratio, on the other hand, reflects the dual nature of silver as a precious and industrial metal. An increase in this ratio may indicate that silver is gaining ground as a safe haven, while a decrease signals a strengthening of copper and, therefore, an economic recovery. Silver is particularly sensitive to industrial dynamics, so the ratio with copper provides useful information on global demand for manufacturing and technology.

The calculation of both ratios is based on dividing the price of gold or silver by the price of copper, expressing how many pounds of copper are needed to purchase one ounce of the precious metal. Monitoring these values is essential to understanding market expectations: a sudden increase can signal economic fears, while a decrease can indicate confidence in industrial growth.

In recent decades, the Gold/Copper Ratio has shown significant spikes during periods of financial crisis , such as the 2008 crisis and the 2020 pandemic, when gold recorded record increases while copper depreciated dramatically. The Silver/Copper Ratio, on the other hand, has shown greater variability , influenced by both economic fluctuations and technological demand for silver.

These reports are valuable tools for investors who want to balance their portfolio between safe-haven assets and industrial metals, providing a clear picture of economic trends and market expectations.

#6. /USD index ratio

The Gold/USD Index Ratio and the Silver/USD Index Ratio are indicators that relate the price of gold or silver to the U.S. Dollar Index (DXY), which measures the strength of the dollar against a basket of international currencies. These ratios are essential tools for understanding the performance of precious metals in relation to the strength of the U.S. currency, since gold and silver are generally quoted in dollars on international markets.

The use of these indicators has become especially relevant since the second half of the 20th century, when the dollar consolidated its position as the global reserve currency. Monitoring the relationship between the price of precious metals and the value of the dollar allows us to assess how currency movements affect the demand for safe haven assets.

The Gold/USD Index Ratio indicates how many units of the dollar index are needed to buy one ounce of gold. When the ratio increases, it means that gold is gaining value against the dollar, suggesting a negative perception of the American currency or strong demand for safe-haven assets. Conversely, a decline in the ratio reflects a strengthening of the dollar and a decrease in the propensity to hold gold.

Similarly, the Silver/USD Index Ratio measures the relationship between the price of silver and the strength of the dollar. Again, a rising value indicates that silver is outperforming the dollar, signaling a greater preference for the white metal as a hedge against currency devaluation. Conversely, a falling ratio suggests that the dollar is considered more stable and attractive relative to silver.

Both ratios are calculated by dividing the price of gold or silver by the value of the dollar index (DXY). Since gold and silver tend to have an inverse correlation with the dollar, these indicators provide early warning of market changes related to monetary policy, interest rates, and global sentiment in the U.S. currency.

In recent years, the Gold/USD Index Ratio has seen significant spikes during times of economic crisis, such as during the 2020 pandemic, when the dollar weakened while gold reached all-time highs. The Silver/USD Index Ratio, on the other hand, has shown greater volatility, reflecting the more speculative and industrial nature of silver compared to gold.

For investors, these ratios are essential to understanding how fluctuations in the dollar can affect the value of precious metals, helping to calibrate asset protection and portfolio diversification strategies.

#7. Real interest rate impact

The Real Interest Rate Impact indicator measures the relationship between the price of gold and real interest rates, which are nominal interest rates adjusted for inflation. This ratio is key to understanding how interest rate movements affect the demand and price of gold, as the precious metal is considered a safe haven in times of economic uncertainty.

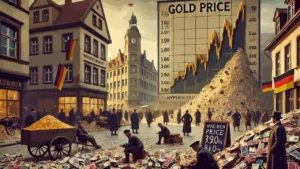

The relevance of this indicator emerged particularly in the 1970s, during the period of high inflation and high interest rates in the United States. In those years, investors tried to understand how gold reacted to the restrictive monetary policies adopted to counteract the increase in prices. Since then, monitoring the impact of real interest rates has become an indispensable tool for analysts and portfolio managers.

The main reason for using this indicator is to assess gold’s ability to preserve value in negative or very low real interest rate environments. Since gold does not earn interest or dividends, its opportunity cost increases when real rates rise. Conversely, when real rates fall or go negative, the cost of holding gold decreases, making it more attractive as a store of value.

The impact of real interest rates is calculated by comparing the nominal interest rate (such as government bond yields) with the inflation rate. A reduction in real rates tends to push the price of gold up, as gold becomes more competitive with yield-generating assets. Conversely, a rise in real rates can cause the price of gold to decline, as investors prefer financial instruments that offer positive interest.

Historically, periods of negative or near-zero real rates have coincided with a sharp increase in the price of gold. During the 2008 financial crisis and the 2020 pandemic, when central banks lowered nominal rates and inflation remained subdued, gold experienced significant growth. This confirms how gold is perceived as a safe haven when real yields do not guarantee adequate capital protection.

For investors, monitoring the impact of real interest rates is essential to assess the future dynamics of the gold price, especially in an environment of expansionary monetary policies or persistent inflation. This indicator is a key tool for making informed decisions on how to balance a portfolio in times of economic uncertainty.

Leave a Reply