Let’s compare the yields of leveraged and non-leveraged gold in order to draw conclusions on which might be the most convenient method to invest in the precious yellow metal.

Disclaimer:

The information provided does not constitute a solicitation for the placement of personal savings. The use of the data and information contained as support for personal investment operations is at the complete risk of the reader.

Contents

#1. ETCs in question

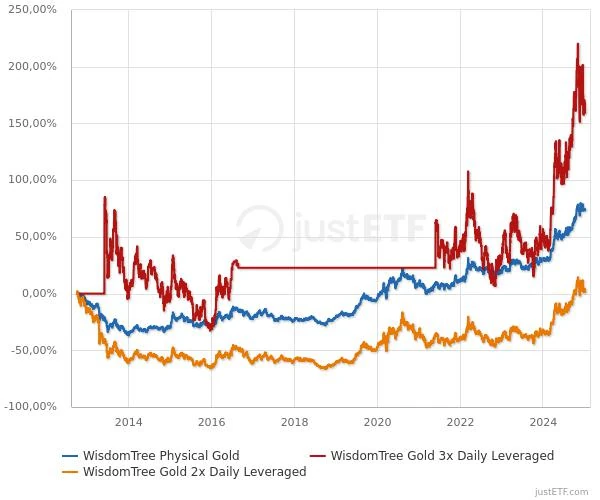

The oldest available data from the funds dates back to 2008. A time span of only 16 years is not the greatest, but I believe it is sufficient to support my final conclusions.

In order to obtain the most consistent results possible, I decided to compare ETCs issued by the same provider, WisdomTree:

- WisdomTree Physical Gold (Unleveraged Gold)

- WisdomTree Gold 2x Daily Leveraged (2x leveraged gold)

- WisdomTree Gold 3x Daily Leveraged (3x leveraged gold)

Due to the interruption, for some periods, of the data provided by the ETC with leverage 3, I invite you to pay close attention in correctly evaluating the returns when these are missing.

#2. Returns over the last 15 years

Comparing 5 standard time frames over the last 15 years, we see that leveraged gold has outperformed unleveraged gold only over the last 5 years.

However, it must be specified that the last 5 years have been characterized by an upward trend, consequently there have been no retracements that would put leveraged gold to the test.

| Period | Without leverage | Leverage 2x | Leverage 3x |

|---|---|---|---|

| Last 15 years (2009-2024) | +279% | +236% | +116% (?) |

| Last 10 years (2014-2024) | +176% | +166% | +177% (?) |

| Last 5 years (2019-2024) | +119% | +163% | +117% (?) |

| Last 3 years (2022-2024) | +54% | +67% | +82% |

| Last year (2024) | +33% | +54% | +75% |

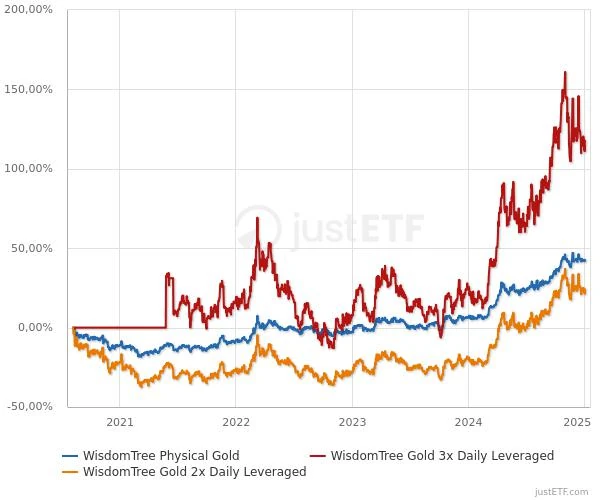

#3. Returns from the last highs

Comparing returns starting from the most relevant 3 previous highs reached, we note that only unleveraged gold has had the best performance.

This, however, is quite normal as buying leveraged before a retracement carries a significant disadvantage in recovery.

| Period | Without leverage | Leverage 2x | Leverage 3x |

|---|---|---|---|

| Pre-economic crisis (02 Oct 2012) | +75% | +4% | +167% (?) |

| First Covid recovery (06 Aug 2020) | +42% | +24% | +117% (?) |

| War in Ukraine (08 Mar 2022) | +32% | +30% | +28% |

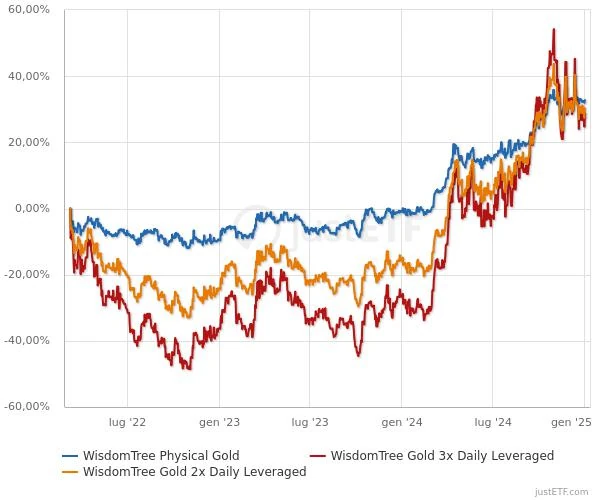

#4. Returns from the last lows

Comparing returns from the most relevant 3 previous lows, we see that unleveraged gold outperformed in almost all cases.

While instinct would suggest superior performance for leveraged gold, the presence of retracements or price sideways movements erode the latter, diminishing its tenacity.

| Period | Without leverage | Leverage 2x | Leverage 3x |

|---|---|---|---|

| Initial data (07 Mar 2008) | +273% | +166% | +116% (?) |

| Economic crisis (27 Dec 2013) | +173% | +161% | +170% (?) |

| Market bubble (04 Mar 2021) | +73% | +96% | +118% (?) |

#5. Returns for complete data

There is no particular reason why the returns over these time periods should be considered in any way significant.

These are only two intervals in which the data of all compared ETCs are fully available.

| Period | Without leverage | Leverage 2x | Leverage 3x |

|---|---|---|---|

| From 02 Jun 2013 to 21 Aug 2016 | +9% | -12% | -29% |

| From 29 May 2021 to 2024 | +58% | +59% | +62% |

#6. Summary analysis

Leveraged gold also has the same advantages and disadvantages as all other leveraged products. Buying leveraged during an uptrend will maximize profits, while buying leveraged before a retracement will only maximize losses.

At this point it perhaps becomes more sensible to buy ETF funds that track high-performing stock indices with leverage as they have the same volatility as gold but with higher returns.

👉 Read also: Returns: Leveraged S&P 500 and Nasdaq 100 📊

Unless you are truly convinced that gold can increase in price in the short term, it is much wiser to recommend purchasing it without leverage through ETCs or in physical form (which I always recommend).

Sources and data:

Leave a Reply