Hyperinflation is one of the most destructive economic phenomena that can affect a country. Zimbabwe, between 2007 and 2009, experienced one of the worst inflationary crises in history, with rates that reached levels that are difficult to conceive.

In this article, we will analyze the most impressive numbers of this hyperinflation, to understand the devastating impact it had on the population and the economy of the country.

Contents

#1. Beginning of the crisis

Inflation in Zimbabwe did not erupt suddenly, but was the result of a series of political and economic mistakes that began in the 1990s. President Robert Mugabe, in office since 1987, implemented policies that profoundly destabilized the economy. One of the main triggers was the 2000 land reform, in which the government confiscated land from large white landowners for redistribution. However, the redistributions were often ineffective, as much of the land ended up in the hands of people with no agricultural experience, causing a dramatic decline in food production.

Added to this was an uncontrolled increase in public spending, financed by the printing of new money, without any real backing. By 2001, the inflation rate had already risen to 112% per year, a worrying value but not yet catastrophic. However, as the years passed, the government continued to print money to try to support the economy, while industrial and agricultural production collapsed. In 2003, the inflation rate reached 598% per year, and in 2006 it officially exceeded 1,000% per year, a sign that the economic system was about to collapse.

Investors and citizens quickly lost confidence in the local currency, the Zimbabwean dollar, which began to devalue at an impressive rate. The population began to accumulate material goods instead of holding on to money, while the government, instead of stopping the inflationary spiral, continued to print more and more money. This directly led to the disastrous two-year period of 2007-2008, in which the country officially entered the most serious phase of hyperinflation.

#2. Numbers of hyperinflation

LHyperinflation in Zimbabwe reached unimaginable levels. In 2007, the official inflation rate was 66,000% per year, but experts estimated that the real value was much higher. 2008 was the year in which the crisis reached its peak, recording one of the highest inflation rates in history. In November 2008, the estimated inflation was 89.7 sextillion percent (89,700,000,000,000,000,000% per year).

Some impressive data from that period:

- Prices doubled every 24 hours, making any economic planning impossible.

- Average validity of a banknote was less than a day, because its value quickly dropped to zero.

- In July 2008, a kilogram of sugar cost 1.5 billion Zimbabwean dollars, and the price doubled within hours.

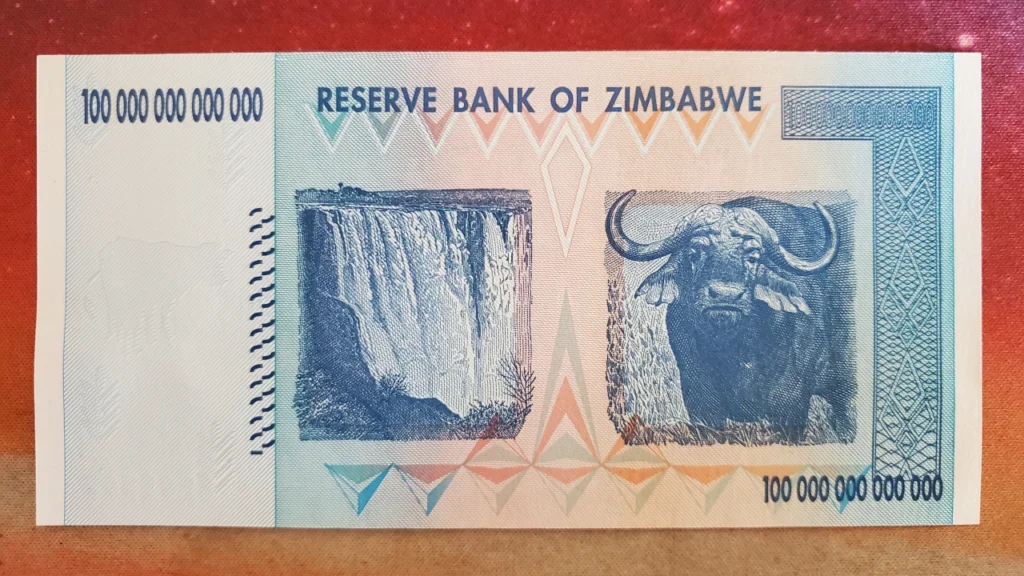

In practical terms, this meant that citizens had to spend their wages immediately upon receiving them, because the next day it would be practically worthless. The value of the currency fell so much that banknotes were printed in ever-higher denominations, culminating in the infamous 100 trillion Zimbabwean dollar note.

#3. The 100 trillion banknote

Uncontrolled inflation forced the government to issue banknotes with ever-higher denominations to try to facilitate everyday transactions. In January 2009, the Zimbabwean $100 trillion note was introduced, the largest denomination ever printed on a national currency.

However, this astronomical amount was completely worthless. When first put into circulation, this note was worth about 0.40 USD on the black market. Within a few days, its value had completely disappeared, making it unusable.

The population was forced to use bags full of banknotes to buy basic necessities. Some merchants even stopped counting them and started weighing them, because it was faster to determine the value of a pile of banknotes by weight rather than counting them individually. This level of absurdity marked the final collapse of confidence in the national currency.

#4. Effects on the population

Hyperinflation had devastating effects on the people of Zimbabwe. Salaries, even those of public sector workers, became worthless in a matter of hours. Businesses and banks stopped lending because no one could repay them with real value.

The most devastating effects were:

- Unemployment soared to 94%, leaving millions of people without any income.

- Price of a normal meal reached billions of Zimbabwean dollars, making it difficult to even buy food.

- Black market became the only functioning economic system, trading in US dollars, South African rands, and other foreign currencies.

Faced with an unsustainable situation, many citizens began to barter beni o a utilizzare monete straniere, rendendo di fatto inutilizzabile il dollaro zimbabwiano.

#5. End of currency

In 2009, the government of Zimbabwe made a drastic decision: to abandon its national currency. The Zimbabwean dollar was officially suspended and the country adopted the US dollar as its base currency.

The effects were immediate:

- Hyperinflation ended almost instantly.

- Prices stabilized and the economy slowly recovered.

- People could finally accumulate savings without fear of their value evaporating.

Zimbabwe was without its own currency for almost ten years, until 2019, when it attempted to reintroduce a new local currency, with disappointing results.

Leave a Reply